Buy DOMS Industries Ltd For Target Rs. 2,845 By JM Financial Services

Capacity expansion & innovation thrust to drive organic growth

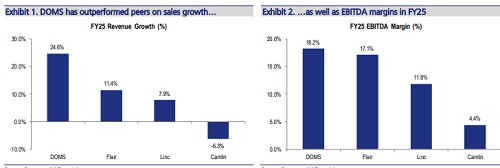

DOMS’ FY25 consol sales grew by c.25% with organic sales growth of c.17% (tad lower vs its guidance of 18-20%). However, this was predominantly driven by capacity constraints (no major capacity addition happened in scholastic stationary/art material in FY25 & some delay in construction activities) and demand has not been a challenge. With addition of lines (for pens, pencil processing, paper stationary, etc.) in existing infrastructure and new greenfield capacities coming up from end of FY26, the supply side challenges should ease. This apart, DOMS has been widening its portfolio (launch of back to school range, DOMS tots range, adhesives, fine arts, paper stationary), which we believe should enable it to achieve organic revenue growth guidance of c.18-20% p.a. over medium term. EBITDA margins are likely to be within guided range of 16.5-17.5%, as focus remains on increasing market share. Going ahead pace of commissioning of new capacities will be key for acceleration in writing instruments. Execution on Paper stationary & Uniclan business (distribution expansion) over medium term will be another key monitorable. We like DOMS brand strength, R&D capabilities, fully backward integrated manufacturing setup and promoter’s ability to leverage these tools to create new growth engines and get product & pricing right. This we believe will enable it to continue outperforming industry growth. Sharp correction in the name should be used as an opportunity to add. Maintain BUY.

* Widening portfolio & creating new growth engines leveraging its innovation/R&D expertise: One of the key strengths of DOMS has been its innovation capabilities in the stationary segment and it continues to remain agile in this aspect – visible from launch of Tots range, widening of its Pens portfolio, launch of back to school range (bags), value added offerings in kits & combos, adhesives range, markers, mechanical pencils & fine art products. DOMS’ R&D and backward integration strength to provide a value for money offering has been instrumental in creating newer growth opportunities, gaining market share in core categories & outperforming peers in stationary segment.

* Capacity expansion to ease supply challenges and drive organic growth: Core stationary segment growth saw some moderation in 4QFY25 vs historical trends – this in our view was primarily driven by capacity constraints (currently at c.90% utilization for core categories) and not any demand side issues. Historically too, capacity has been a challenge for DOMS & it has been investing behind adding lines across categories. Apart from expanding at the existing infrastructure (from 22 acres to 26-27acres, added injection molding machines for pens), the construction of 44 acre greenfield capacity is also under progress (first building to commercialize in Mar/April’26). Overall capex for greenfield project is c.INR 10bn (INR 2.2-2.3bn p.a in FY26/27E) & in normalized scenario, the asset turn achievable in this business is c.3x. Phase wise capacity expansion is being undertaken in core categories in FY26 – Pencils (from 5.5mn pencils/day to 8 mn/day), Pens (from 2.2 mn pens/day to 3.2-3.5mn pens/day by Mar’26) and Paper stationary (new line added in Pioneer & acquisition of Super tread). This we believe should ease supply challenge which along with continued innovation intensity across categories should help achieve its organic sales growth guidance (c.18-20% p.a).

* Enough headroom to scale up in Pens; well placed to capitalize on opportunity with capacity & portfolio in place: DOMS’ has clear demonstrated its execution capabilities (sales up 3.5x over FY23-25, accounting for c.7% of gross stationary sales) in a competitive and large category (market size of INR 100bn) like Pens. Company had entered this category around two years back, when key industry players decided to exit INR 5 price point. DOMS saw this as an opportunity to enter a large category, leveraged its strong R&D capabilities and created superior product offering at a value for money price point (for e.g.: Gel pen at INR 5). The range has been well accepted, visible from its strong growth in this segment. Also, despite majority range being at INR 5, the profitability in this segment is similar to company level margins. Moreover, headroom for growth remains immense - DOMS’ pens are still not launched pan-India (present only in c.50% of the market) and market share is still in low single digits. With capacities getting added (3.2-3.5mn pens/day by Mar’26 & aspiration to reach 10mn in another 2 years), we expect strong traction in this category to continue & it will remain one of the key revenue drivers for DOMS over medium term.

* Paper stationary – Capacity additions to help tap large TAM: Segment offers large growth opportunity (market size of INR 100 bn with DOMS’ market share in low single digits). DOMS entered in this segment through acquisition of Pioneer stationary Ltd in FY16. Over the years, revenue has scaled significantly from INR 45 mn to INR 1.6bn (in FY24) – led by a combination of category expertise of existing promoters of Pioneer and DOMS’ brand/distribution strength. While business margins are lower & entails higher working capital (higher credit period) vs conventional stationary products, the TAM is much larger to be ignored. Also, focus here is more on kids/back to school products where it has right to win and can leverage its brand & distribution strength. Capacities have been added in Pioneer (20% increase in Oct’24); recent acquisition of Super Treads (West Bengal based paper manufacturing entity) will further increase overall capacity by another 30% and also enable to widen geographic presence in a more cost efficient manner.

* Strengthening distribution infrastructure: Apart from working on portfolio and capacity expansion, DOMS has also been focusing on expanding & driving efficiencies in its distribution. Currently, it has total reach of 140k stationary outlets with direct reach to 125k outlets. It plans to reach at least 175-200k outlets directly over the medium term & balance universe (another 100-150k) will be served through wholesale channel. This apart, in order to increase thruput per store, DOMS has increased its sales team strength & created separate sales lines – existing sales team continuing with core stationary products and additional sales line for its new product segments which are Pens, Paper stationary, and Adhesives. Also, to ensure better visibility on secondary sales, it is onboarding c.30% of distributors (which account for large part of its sales) onto DMS system.

* Uniclan - focus on getting the product right before accelerating distribution expansion in GT: DOMS acquired Uniclan (Wowper diapers/wipes) with a strategy to create distribution reach in GT channel, outside of the stationary shop universe over next 3-5 years which can then be leveraged to scale up its stationary business. With capacity in place & given the large opportunity in diapers/wipes segment, the focus now is on a) creating differentiated product leveraging technology & existing promoter’s expertise in the space and b) right sizing of distribution structure (reducing CFA from its 3 layered distribution structure). Once the right portfolio is in place, aggressive scale up/distribution expansion will be done across markets. Currently, Uniclan’s reach is at 35k outlets (Wowper is largely tier 3 brand with presence in states like UP, Bihar, Rajasthan, etc.) & DOMS is onboarding some of its existing channel partners for distribution of Wowper portfolio. Uniclan’s sales grew by c.15% yoy to INR 1.7bn (on full year FY25 basis) & management expects c.20% sales growth with EBITDA margins c.8-10% for this portfolio over the medium term.

* Exports to see traction with dedicated facility coming up under greenfield expansion project: While servicing & gaining share in domestic market remains a key focus area over the medium term, export of stationary products (account for 15% of its sales of which 60% is to FILA & balance is its own branded products) is also a large opportunity which can be tapped at later stages leveraging its manufacturing capabilities and its strategic relationship with FILA. DOMS has entered into distribution agreements with FILA wherein later will distribute DOMS-branded stationery products across select international markets, leveraging its entrenched local infrastructure & regulatory familiarity. Also, with dedicated building for FILA coming up in 44 acre capacity expansion project, export sales could see uptick in FY27.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361