Buy Godawari Power And Ispat Ltd for the Target Rs.299 by GEPL Capital Ltd

GPIL, formerly Ispat Godawari Ltd., is the flagship Raipur-based Hira Group steel company, established in 1999, specializing in long products, mainly mild steel wire, with integrated steel and captive power operations.

Investment Rationale

* Integrated steel value chain with captive resources driving efficiency and cost savings:

GPIL is a fully integrated steel producer with strong backward linkages. Its two captive iron ore mines meet ~85% of requirements, while 98 MW of captive power (waste heat, biomass, and coal) and 100 MW of solar capacity ensure energy self-sufficiency. Another 70 MW solar project is underway to support pellet expansion. The company also has a Coal India supply tie-up. Forward integration into wire rods and HB wires diversifies revenue and boosts margins. Co-located beneficiation and rolling mills cut transport and reheating costs, while a new beneficiation plant will further reduce logistics and royalty expenses, enhancing profitability.

* Strong Growth Visibility Backed by Integrated Expansion and Margin Accretion:

GPIL’s expansion across mining, pellets, and downstream products provides strong earnings visibility, with 2 MTPA pellet capacity, Boria Tibu mining resumption, and Ari Dongri’s 6 MTPA expansion driving 20–25% volume growth in FY26. Its fully integrated value chain enables operating leverage, industry-leading EBITDA margins (24% in Q1FY26), and sustainable cash flows despite price volatility.

* Diversified Growth Drivers with High ROI, Capital-Efficient Projects:

GPIL’s Rs.1,600 Cr CAPEX into the Cold Rolling Mill and Battery Energy Storage System diversifies it into high-margin, future-ready segments VAD steel and renewable energy storage. With low leverage <0.5x, strong internal funding, and BESS ROIs of 40–50%, these projects boost profitability and cash flow. Projected FCF of Rs.3,000 Cr (FY27–FY28) enables self-funded growth for the Rs.4,500– Rs.5,000 Cr greenfield steel project, driving long-term value with minimal balance-sheet risk.

* Valuations:

We model a Revenue/PAT CAGR of 20%/25% and estimate GPIL to clock PAT of Rs 9,289 Cr by FY28E. is trading at forward P/E(x) of 11x and we value at 13(x) FY28E and Recommend BUY on GPIL with target Price of Rs. 299 (14%).

Observation

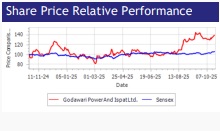

* GPIL has been forming a series of higher tops and bottoms on the monthly scale since 2020, reflecting a sustained uptrend. During this period, the stock has shown phases of time-wise consolidation following sharp rallies.

* A similar pattern has emerged recently, as after a strong upmove from June 2023 to June 2024, the stock entered a healthy consolidation phase and has now registered a breakout from a 14-month congestion zone.

* On the weekly scale, it has taken support near the 38.2% Fibonacci retracement level of the prior rally from 174 to 278. On the daily scale, the stock is showing a bullish mean reversion from the 50-DEMA, forming a fresh base pattern that signals the continuation of bullish momentum across timeframes.

* The MACD indicators remain in buy mode, further reinforcing the positive outlook.

* Given this robust alignment across multiple timeframes, the stock looks poised to advance toward an upside target of 295, while a closing-basis stop loss at 249 is advised to manage risk effectively.

TECHNICAL VIEW

Source: Tradingview.in, GEPL Research

Inference & Expectations

* Considering these factors, it can be inferred that GPIL stock is set to continue uptrend.

* Going ahead we expect the prices to move higher till 299 level.

* The stop loss must be at 249 level, strictly on the closing basis.

SEBI Registration number is INH000000081.

Please refer disclaimer at https://geplcapital.com/term-disclaimer

.jpg)

.jpg)