Buy JK Cement Ltd For Target Rs. 5,300 By JM Financial Services

Better market mix and strong execution to drive earnings

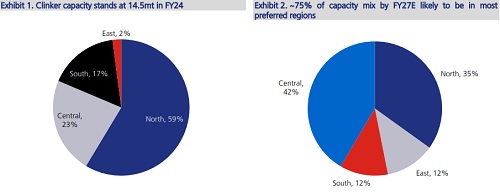

JK Cement (JKCE) is targeting to double its grey cement capacity to 50mt by FY30 (14% CAGR, ~2.5x ahead of industry forecast), which will enable it to register strong volume growth with market share gains over the next few years. Better market mix with a strong presence in preferred markets such as North and Central (~75% of capacity mix) should augur well for JKCE compared to peers. Besides, it has enough levers for structural cost improvement of ~INR 100/tn over the next couple of years. Despite factoring in capex of INR 38bn over FY25E- FY27E, we estimate net debt to remain range-bound at ~INR 40bn over FY25E-27E owing to strong OCF generation. We maintain BUY with Mar’26E TP of INR 5,300 based on 16x FY27E EV/E. JKCE is our preferred pick in the mid-cap space.

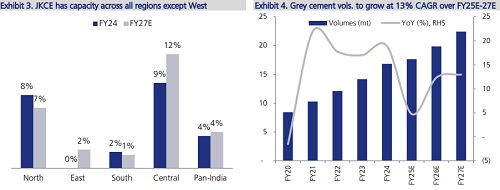

* Gaining scale steadily through strong execution: JKCE has consistently maintained a healthy capacity addition trajectory, with grey cement capacity CAGR of 17% during FY19-24 (current capacity at 24.3mt). Its clinker/ cement capacity is likely to increase to ~18mt/ 30mt by FY26. Besides, it aims to increase capacity to 50mt by FY30 (14% CAGR), with the next leg of expansion through the greenfield/brownfield route and fairly spread across regions with likely capex of USD 75-80/tn. Earlier, the management had guided for 7-8% YoY volume growth for 4QFY25 and 10% for FY26. Besides, our checks suggest that average cement prices in North and Central have likely increased by ~INR 10 / INR 5-6 per bag respectively in 4Q, which should augur well for profitability.

* Sustainable cost-saving potential of ~INR 100/tn over the next 2 years: The management targets sustainable cost savings of ~INR 100/tn (in addition to likely savings of INR 50/tn in FY25) through: 1) increasing share of green power (from 50% in 9MFY25 to >60% by FY26 and 75% by FY30); 2) higher thermal substitution (11% in 9MFY25, targets to increase it by another 10% in the next 2-3 years); 3) logistics cost optimisation through reduction in lead distance by 15km (~INR 45-50/tn); and 4) operating leverage benefits stemming from higher volume growth and other initiatives. This will help to either increase market share further or improve profitability.

* Strong OCF to aid the next leg of growth; net debt unlikely to increase: With increased scale of operations, we expect JKCE’s OCF to increase ~2x over FY25E-27E vs. the average OCF over FY19-22. Its balance sheet remains strong, and despite INR 38bn capex that is to be incurred during FY25E-27E, we expect consolidated net debt to remain range-bound at ~INR 40bn given the healthy OCF during the period. The management has guided for ‘net debt to EBITDA’ of <2x.

* EBITDA CAGR of 21% over FY25E-27E: We factor in consolidated volume CAGR of ~12% over FY25E-27E with EBITDA/tn likely to improve to INR 1,135 by FY27E. We are structurally positive on the company given growth visibility, controlled leverage and return ratios being above its cost of capital. White cement/ wall putty (~18-20% of EBITDA) along with higher other operating income (~19% of EBITDA in 9M vs. 10% in FY22) will cushion volatility in earnings during a weak grey cement pricing scenario.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361