Add Sagar Cements Ltd For Target Rs. 227 by Centrum Broking Ltd

Depressed realizations continue to hurt margins

Sagar Cements (SGC) reported numbers ahead of our estimates but depressed realizations in its core markets continued to hurt margins as EBITDA/mt came in at Rs273, which is one of the lowest in our coverage universe. Better-than- expected EBITDA is largely due to lower-than-expected costs, which at Rs3,813/mt declined by 8% YoY, driven by lower P&F costs. While demand growth, which has been languishing in south, has picked up in recent weeks. But, realizations continue to be depressed, resulting in extremely weak margins. SGC has reported losses at the PAT level for 10 out of the past 12 quarters and hence higher realizations are eagerly awaited. We have maintained our estimates on SGC. We are building in EBITDA/mt of Rs718 for SGC in FY27. Maintain ADD rating.

Q3FY25 result summary

Revenue at Rs5.6bn declined by 16% YoY but was 3% above our estimate. Volume came in at 1.38mn mt and was down 2% YoY but 3% above our estimate. Realization was flattish QoQ at Rs4,086/mt and in line with estimate. Absolute EBITDA exceeded our expectation by 32% as largely all operating expenses reported a decline, except employee costs. Employee costs were elevated in Q3FY25 due to annual appraisals during Q3FY25. The company reported a loss of Rs545mn vs a loss of Rs146mn last year. Utilization during the quarter stood at 53%

Awaiting price hikes in AP and Telangana

State elections in Telangana and AP followed by general elections have taken a toll on government spending in southern states. Given the weak financial profile of both AP and Telangana, pick-up in spending has been slower than anticipated. As a result of weak demand and increased supply, cement prices have remained depressed in AP and Telangana. South as a whole remains one of the weakest regions in terms of pricing growth and volatility in profitability as swings in cement prices is likely to result in uncertainty about price recovery in the region

Utilization expected to remain subdued

SGC is currently operating at 53% utilization levels as ramp-up of recently acquired Andhra Cement assets remains slow. While we expect utilizations to improve to 61% by FY27, it still remains below all-India average, leading to lower operating leverage.

Valuation and outlook

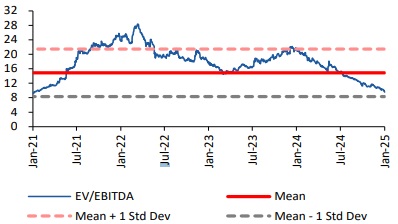

SGC remains exposed to the volatility of cement prices in the fragmented southern market, posing risks of oversupply and reduced utilization rates. We are building in impressive 12%/32% CAGR over FY24-FY27 for SGC from a weak base. Overall, we expect EBITDA to grow from Rs2.5bn in FY24 to Rs5.6bn in FY27. We value SGC at 8x FY27E EV/EBITDA to arrive at our target price of Rs227. We maintain our ADD rating

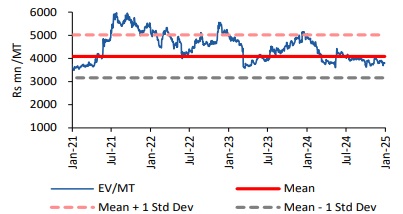

EV / MT mean and standard deviation

EV/EBITDA mean and standard deviation

For More Centrum Broking Disclaimer https://www.centrumbroking.com/disclaimer/

SEBI Registration No.:- INZ000205331