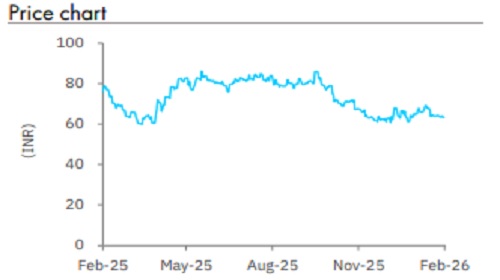

Buy Restaurant Brands Asia Ltd For Target Rs 100 By Elara Capital

Operating leverage-led positive Q3

Restaurant Brands Asia (RBA IN) Q 3 was a beat , with a higher same -store -sales -growth (SS SG) of 4.5%, marking a 10-quarter high (backed by lower discounts and price hikes), resulting in robust gross margin accretion , which is likely to sustain. In Indonesia, the pace of cost -cutting s eems to have largely hit a plateau, implying juiced -out initiatives with operating leverage (perhaps) are the way forward for profitable operations. Continued SSSG and margin delivery may aid in share price show, and we have yet to factor in new -Inspira Global deal subject to shareholder and regulatory approvals. Our growth and margin initiatives are unchanged with Indonesia offsetting BK India ; we remain positive on RBA’s outlook with structural growth and margin levers . We r etain Buy with a TP of INR 100.

SSSG gains traction: BK India’s revenue grew by 13.7% YoY; SSGS delivery was strong at 4.5% YoY, the best in the past 10 quarters, apart from store network expansion (+44 to 577, up 13.1% YoY), growth was led by robust dine -in traffic (due to by special offers - driving positive SSTG ), new launches – the Korean Spicy fest and strengthening core menu. RBA says value proposition remains core focus. BK India has a new product pipeline to drive incremental growth as it aims to market it effectively . With Q4 show encouraging, we expect H2 to be better than H1. With 577 stores in Q3, management targets 600 stores by FY26 and re iterates guidance of 60 -80 store add ition un til FY29.

Indonesia operations posts steady performance: Geographical revenue fell 4.4% YoY, led by SSS decline of 1.0% and store closures (closed nine , taking total to 138, down 6.1% YoY) . RBA’s intervention on the cost front continues, with G&A expense down by 4% on YoY, but flat QoQ. In Q3, restaurant EBITDA loss w as at INR 55mn , down 13.0%YoY. Growth challenges at Popeyes expected to sustain, although it has strengthen ed its chicken menu. We believe the current cash burn rate will continue until growth -led operating leverage kicks in.

Gross margin feeds into EBITDA: Despite value -focused strategy, BK India gross margin was up 155bp QoQ to 69.9 %, driven by pricing action and lower discounts on the delivery channel (part of which is likely fed to dine -in offers, we believe ). Moreover, cost control in other expenses – solar panel and new broilers – cut expenses by 2.0% QoQ, bo lstering EBITDAM by 292bp Qo Q to 16.6%. We believe margin gains are structural, resulting in positive outlook .

Retain Buy with a TP of INR 100: Q3 show was ahead of estimates, led by favorable pricing action driving operating leverage, and GST -led benefits implying comfort , we believe. SS SG and execution remain noteworthy, and hence we keep our estimates unchanged . RBA has likely gained in market share , in our view . As it expect s margin to sustain and positive SSSG outlook , on -track delivery could drive better share price performance. With large -scale cost - cutting behind us, only growth can revive BK Indonesia , a key rerating driver . RBA alludes new promoter -led fund infusion to back expansion , although we await strategic outlook , and shareholder & regulatory approvals to factor in dilution and cash infusion (refer to our note ). We retain Buy with a TP of INR 100 on BK India on 27x September 2027E E V/EBITDA (pre - IndAS) and the Indonesian arm on 2 x, September 2027E EV/sales .

Please refer disclaimer at Report

SEBI Registration number is INH000000933