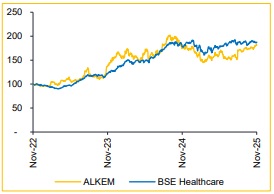

Reduce Alkem Labs Ltd For Target Rs. 5,760 By Choice Broking Ltd

Pipeline Progress Not Enough to Offset Near-term Challenges

With revenue growth expected to remain in low double digits and margins largely flat in FY26, ALKEM’s overall fundamental trajectory remains unchanged. While high-value launches, such as Semaglutide, Tolvaptan and Valsartan could drive moderate margin expansion, from FY27E, this remains dependent on the pace at which these launches scale up. PAT growth will also be constrained by the expiry of MAT credits and a sharp rise in ETR to 30–35% (vs. 13–15% currently), limiting near-term earnings upside. We expect Revenue/EBITDA/PAT to deliver a CAGR of 12.5%/16.0%/9.2% over FY25–28E. That said, medium-term visibility has improved with (1) the GLP-1 opportunity on approval and (2) the US CDMO facility, which carries revenue potential of INR 3,000 Mn over 12–18 months. To reflect this, we revise our valuation multiple to 25x (from 20x). Applying this to the FY27–28E average EPS yields a revised TP of INR 5,850 (vs. INR 4,750 earlier) and upgrade our rating to REDUCE.

Robust Quarter with Growth and Margin Expansion

* Revenue grew 17.2% YoY / 18.7% QoQ to INR 40,010 Mn (vs. CIE estimate: INR 36,194 Mn).

* EBITDA grew 22.3% YoY / 24.6% QoQ to INR 9,208 Mn (vs. CIE estimate: INR 7,673 Mn); margin expanded 97 bps YoY / 109 bps QoQ to 23.0% (vs. CIE estimate: 21.2%).

* PAT increased 11.1% YoY / 17.2% QoQ to INR 7,651 Mn (vs. CIE estimate: INR 6,882 Mn).

Double-digit Growth Supported by US Scale-up and India GLP-1 Launch

The US market registered strong growth in the quarter, supported by the launch of sacubitril–valsartan. We expect the US business to grow in low double digits in FY26, driven by 3–4 planned launches and steady momentum in the base portfolio. In India, growth is likely to outpace the IPM by 100–150 bps, supported by chronic recovery, strong traction in diabetes (growing at 2x) and the anticipated GLP-1 (Semaglutide) launch in January 2026, which could materially strengthen the domestic franchise. Additionally, the CDMO facility in the US provides a meaningful long-term growth option. Overall, we expect consolidated revenue to grow in double digits.

Integration Cost Keeps FY26 Margin Flat

While Q2 margin expanded by 100 bps to 23%, the full-year FY26 margin guidance remains unchanged at 19–20%. This reflects the expected loss of GSTlinked Sikkim benefits in H2, continued Medtech losses and higher cost arising from the integration of Bombay Ortho and Adroit. However, as new launches scale up and integration gets completed, we expect moderate expansion.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131