Accumulate Sudarshan Chemical Ltd For Target Rs.1,047 By Elara Capital

Heubach reset leads to earnings volatility

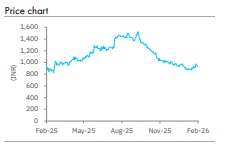

The stock price of Sudarshan Chemical (SCHI IN) has fallen 11% in the past three months, and it underperformed the NSE Small-Cap Index (down 6%), due to margin concerns post the Heubach acquisition and weakening of dyes & pigments demand globally. SCHI delivered a weak Q3FY26 quarter, with consolidated PAT taking a hit by continued softness in global pigment demand, prolonged customer destocking in legacy Heubach products, and adverse mix & pricing in the acquired business. While legacy SCHI margin remain resilient at ~13% in pigments, the acquired Group fell into EBITDA loss in Q3, prompting management to revise down FY26 Heubach profitability guidance. The company highlighted early signs of Heubach customers restocking during January–February and reiterate confidence in a multi-year margin recovery, led by integration progress, value capture, and working capital normalization. Based on revised FY26 guidance for acquired business (Heubach), we decrease our EBITDA estimates by 5% for FY26E, 4% for FY27E and 8% for FY28E. We roll over TP to FY28 estimates. We retain Accumulate with a TP of INR 1,047.

PAT turns red due to losses at Heubach: SCHI reported an adjusted EBITDA of INR 379mn, down 71% QoQ with net loss of INR 699mn vs our estimates of INR 200mn. The company reported a revenue of INR 21.0bn, down 12% QoQ. Q3 EBITDA loss for the Heubach Group was INR 380mn vs modest profit in Q2. Revenue from the legacy business was down 3% YoY to INR 6.5bn. Management attributed the Heubach decline to volume deleverage, mix deterioration, pricing pressure, and high inventory at customer-end, which continues to unwind slower than expected post the insolvency phase. Importantly, legacy SCHI pigments remain structurally stable, delivering ~13% EBITDA margin.

Heubach guidance reset – business EBITDA cut; recovery back-ended: Management has lowered Heubach’s FY26 business EBITDA target to ~EUR 16mn from EUR 25mn, with Q4 likely to contribute EUR 9–10mn, driven by improving sales momentum and accelerating value capture. In the medium term, management continues to target a significant profitability turnaround, and targets to EUR 90–100mn business EBITDA by FY28-29. However, the company flagged reported EBITDA may remain temporarily depressed for the next few quarters, due to a reduction of legacy finished goods inventory (~EUR 30–40mn), which could lead to overhead release impact of ~EUR 9–12mn — negative for accounting profitability but positive for operating cashflow and balance sheet deleveraging.

Retain Accumulate with a TP of INR 1,047: Based on revised FY26 guidance for acquired business (Heubach), we decrease our EBITDA by 5% for FY26E, 4% for FY27E and 8% for FY28E. We roll over TP to FY28 estimates. We retain Accumulate with a TP at INR 1,047. Our TP is based on a DCF valuation, assuming a 4% terminal growth rate and a 10.9% cost of capital.

Please refer disclaimer at Report

SEBI Registration number is INH000000933

.jpg)