Buy Inox Wind Ltd for the Target Rs. 150 by Motilal Oswal Financial Services Ltd

Soft quarter as delivery momentum disappoints

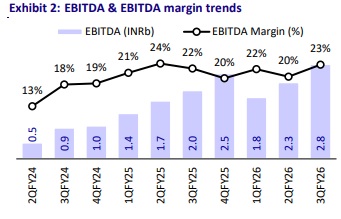

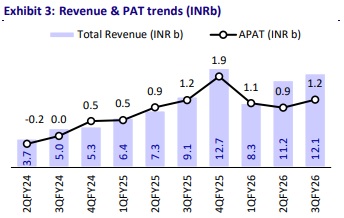

? Soft 3Q as deliveries fall short of our expectations: Inox Wind (IWL) reported a quarterly consolidated revenue of INR12.1b (+33% YoY, +8% QoQ), which missed our estimates by 34%, largely on account of weakerthan-expected execution of 252MW vs. our estimate of 300MW. Reported EBITDA of INR2.8b, missed our estimates by 15%, even as EBITDA margin remained strong at 23%. The order book stood at 3.2GW (49% WTG and 51% turnkey) at the end of 3QFY26, flat YoY and QoQ

? What did we like about the result: 1) management commentary about the sector and new order outlook remained positive, and IWL remains confident about growing the order book; 2) EBITDA margin guidance was pushed up to 22% for FY26 and 20-22% for FY27 (vs. our previous estimate of 17-18%); 3) the company expects a strong 4QFY26 earnings performance (as implied by FY26 guided revenue and EBITDA estimates); 4) as per IWL, the working capital cycle is now down to 220 days (from 300+ days in FY25) and is expected to decline to 200/150 days by the end of FY26 and FY27.

? Key monitorables: 1) new order inflows at 600MW are trailing our est.; 2) while EBITDA margin guidance was raised, there was a sharp cut in revenue guidance amid soft realizations and a slow pace of deliveries.

? Cut our FY26E/FY27E PAT by 10%/5%: We cut our FY26 and FY27 PAT estimates by 10% and 5%, respectively, as we adjust deliveries and realizations slightly lower. Our revised estimates are broadly in line with the revised company guidance.

? Valuation and view: We cut our valuation multiple to 20x (from 24x), given 1) weaker sentiment in the wider market as well as in the power/renewables sector, 2) a modest cut to earnings, and 3) a slower-than-expected pace of new orders. Our revised TP of INR150 (based on 20x FY28 EPS) implies 42% potential upside. Reiterate BUY.

Miss on earnings as execution falls short of expectations Financial performance

? IWL reported a quarterly consolidated revenue of INR12.1b (+33% YoY, +8% QoQ), which missed our estimates by 34%, largely on account of weakerthan-expected execution of 252MW vs. our estimate of 300MW.

? IWL reported an EBITDA of INR2.8b, missing our estimates by 15%, but improving 38%/24% YoY/QoQ. EBITDA margin came in at 23%, beating our estimate of 18% by 540bp.

? With a higher-than-expected tax rate of 40%, the company has reported its Adj. PAT at INR1.2b (-6% YoY, +28% QoQ), missing our estimate by 38%.

Operational performance ? IWL reported execution of 252MW (+33% YoY, +25% QoQ), missing our expectation of 300MW by 16%.

? The order book of IWL stood at 3.2GW (49% WTG and 51% turnkey) at the end of 3QFY26, flat YoY and QoQ.

Inox Green

? Inox Green’s revenue was reported at INR0.8b (+34% YoY, -5% QoQ) with EBITDA at INR0.2b (+46% YoY, +165% QoQ), with EBITDA margins at 27.8% (vs. 10% in 2QFY26). ? Inox Green’s O&M contracted capacity expanded further to 13.3GW in 3QFY26 from 12.5GW in 2QFY26.

Highlights of the 3QFY26 performance

? IWL expects to achieve around INR50b in consolidated revenue for FY26, supported by healthy order inflows.

? The company’s order book stood at 3.2?GW at the end of 3QFY26, ensuring revenue visibility for the next 18–24 months.

? The company has guided for EBITDA margins of 20–22% in FY26, with a similar margin range expected to be sustained into FY27. ? For FY27, management is targeting approximately 75% growth in consolidated revenue.

? Working capital days are expected to be reduced to 200 days by the end of FY26 and further down to 120–150 days by FY27.

? Inox Green is guiding for over INR6.0b EBITDA by FY27 on its 13.3?GW managed portfolio, maintaining high fleet availability and benefiting from new turbine additions.

Valuation and View

? We cut our valuation multiple to 20x (earlier: 24x), given 1) weaker sentiment in the wider market as well as in the power/renewables sector, 2) a modest cut to earnings, and a slower-than-expected pace of new orders. Our revised TP of INR150 (based on 20x FY28 EPS) implies 42% potential upside. Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)