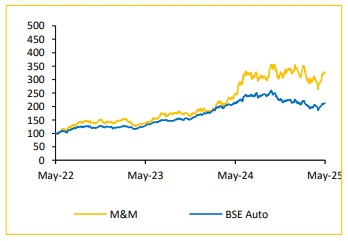

Buy mahindra and mahindra Ltd For Target Rs. 3,965 - Choice Broking Ltd

MM reported an inline performance, with strong SUV sales

* Standalone revenue stood at INR 3,16,087Mn, reflecting a 24.3% YoY and 2.1% QoQ growth (vs consensus est. of INR 3,00,242Mn). Total volumes reached 3,41,046 units, driven by a 17.5% YoY increase in auto volumes, a 22.9% YoY rise in tractor volumes, and a 4.6% YoY growth in ASP.

* EBITDA was reported at INR 42,193Mn, (vs consensus est. INR 42,045Mn), up 23.1% YoY and down 12.3% QoQ. EBITDA margin was down 13bps YoY and 218bps QoQ to 13.3% (vs consensus est. of 14.0%).

* PAT for Q4FY25 reported at INR 24,372Mn, (vs consensus est. INR 24,901Mn), up 21.9% YoY and down 17.8% QoQ.

Scaling Market Share and Premium Product Mix Boosting Profitability: MM delivered strong revenue growth across its core Auto and Farm segments, with consolidated topline rising 14% YoY. A key contributor to this performance was the 18% growth in SUV volumes, outpacing industry growth and driving a 210bps market share gain to 22.5%. This shift was not merely volumetric — it was strategic, as higher-margin models and trims continued to see robust demand. The traction gained by recently launched vehicles and a disciplined focus on premiumization has translated into higher ASPs, supporting better operating leverage and a margin-accretive topline.

Electric Vehicle Profitability Turns the Corner with Capacity in Sight: The company’s EV arm MEAL, posted a positive EBITDA of INR 100Mn in its very first quarter without accruing any PLI benefits, signaling the viability of its electrification journey. While MEAL reported a PBIT loss of INR 1660Mn in Q4 FY25 due to depreciation costs associated with recently launched products, this is expected to improve as volumes ramp up and fixed costs get better absorbed. To support this scale-up, MM has already operationalized a monthly EV production capacity of 5,000 units. Further, the company is expanding capacity by an additional 1.2Lakh units at its Chakan facility, with production on its nextgeneration EV platform slated to begin in 2027. In parallel, a new greenfield plant is being planned (site under finalization) to relieve existing bottlenecks and accommodate an entirely new range of EV products post-FY28.

View and Valuation: We have revised our FY26/27 EPS estimates downward by -10.4%/-8.6%, factoring in the uncertain global macroeconomic environment, including persistent inflation and elevated living costs. Despite the cut, we maintain our BUY rating with a revised target price of INR 3,965, rerating the stock at higher multiple of 25x FY27 EPS (previously 21x, best among OEM peers) plus subsidiary valuation. The revision reflects our confidence in the company’s robust growth outlook, with Revenue/EBITDA/PAT expected to grow at a CAGR of 20.1%/18.9%/22.9%, alongside continued market share gains (22.5% in SUV market and 43.3% in tractors ) and no significant US exposure.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131