Add Trent Ltd For Target Rs. 6,245 by Centrum Broking Ltd

.jpg)

Trent’s Q4FY25 print was in-line with our estimates; consolidated Revenue/EBITDA/APAT grew 27.9%/38.8%/129.1% YoY; standalone sales grew 28.8% YoY on the back of mid single digit LFL growth in these fashion concepts. With 1,091 stores in 240+ cities, store count for Zudio/Westside grew 40%/7% YoY. Gross margin stood at 41.7% (down 240bps) due to an adverse mix. EBITDA at Rs6.5bn grew by 38.8% YoY, with EBITDA margin coming in at 15.5% (+122bps). For the Fashion portfolio, LFL growth was in mid single digits while it was in double digits in FY25 despite aggressive store additions. The management continues to build presence in Metro/Tier 1 cities and improve share of revenue across key markets. We believe that Zudio would witness strong traction on the back of product offers, store portfolio and efficient supply chain management. Revenue for Star Bazar (78 stores) jumped 17% YoY, driven by LFL growth of 2%. Given the multi-pronged growth strategy, we remain optimistic about Trent while higher store additions in Zudio (FY25: 222 vs 200 earlier expectation) could be halted for lower LFL growth, which might be an overhang on the stock. We have tweaked our earnings and retained our ADD rating with an unchanged SOTP target price of Rs6,245 (EV/EBITDA 47.0x on standalone FY27E).

Zudio continue to deliver strong revenue backed by store expansion

Trent’s consolidated revenue grew by 27.9% YoY whereas standalone revenue grew 28.8% YoY. With 1,091 stores in 240+ cities, store count for Zudio/Westside grew 40%/7% YoY. The management believes that the fashion portfolio continues to be differentiated by disciplines & choices and it continues to build further presence in Metro/Tier 1 cities. Revenue for Star Bazar (78 stores) jumped 17% YoY, driven by LFL growth of 2%, with growth driven by own brands, staples, fresh & general merchandise offerings. In Q4, the company added 13 Westside and 132 Zudio stores, reaching total count of 248 for Westside and 765 for Zudio. We remain optimistic about Trent while higher store addition in Zudio (FY25: 222 vs 200 earlier expectation) could be halted for lower LFL growth. We expect ~28+% revenue CAGR for the next two years, led by Zudio followed by Westside and Star.

Gross margin declined while lower opex improved operating margin

Gross margin contracted by 240bps to 41.7% due to an adverse mix and higher RM prices. EBITDA grew 38.8% YoY to Rs6.5bn despite higher other expenditure (+27.0%), rent (+7.0%) and employee cost (+2.2). EBITDA margin came in at 15.5% (+122bps) on the back of lower rent & employee cost as % on sales. We believe that despite higher share of Zudio, margins would have been maintained ~15-16%. Star format saw improved customer traction, helping to lift profitability in our view. Management believes that Star will be the additional growth engine for the company’s portfolio in times ahead. Further, with 100% merchandise carrying RFID tags, it has significantly reduced obsolete inventory in the system. Management said it would apply similar playbook to Star business with a cluster-based approach using hyperlocal sourcing strategy to ramp up own labels (70% of the revenues).

Valuation

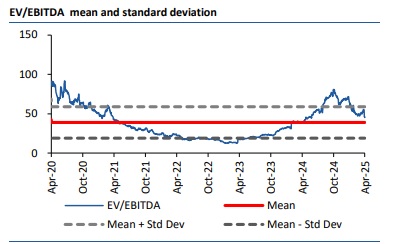

Trent delivered a strong performance (higher store expansion) and moderate SSSG, indicating (1) successful marketing strategy to drive value-for-money customers (2) sharp price points leading to customer traffic (3) right store matrix. Although we are optimistic about Trent’s growth story but stretched valuation provides lower margin of safety. We have maintained our ADD rating and assign 47x to domestic business with an unchanged SOTP-based target of Rs6,245 (EV/EBITDA of 43.7x FY27E).

For More Centrum Broking Disclaimer https://www.centrumbroking.com/disclaimer/

SEBI Registration No.:- INZ000205331