Accumulate Indraprastha Gas Ltd For Target Rs.195 By Elara Capital

Steady volume, but margins still soft

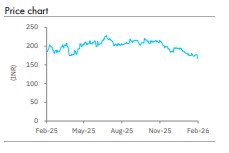

The stock price of Indraprastha Gas (IGL IN) has dropped 22% in the past three months and underperformed the Nifty Mid-Cap Index (down 2%), driven by fears of margin pressure with recent ~10% jump in crude oil prices and INR weakening. Operating performance was steady in Q3FY26, with reported volume growing despite continued phase-out of institutional bus demand (DTC). However, EBITDA/scm margin remains below the company’s target of INR 7- 8/scm, and the pace of EBITDA/scm recovery is slow. While regulatory changes (two-zone tariff + Gujarat VAT rationalisation) provide margin support into FY27, near-term earnings are being weighed down by gas cost volatility and adverse FX impact

We have revised our assumptions, accordingly, leading to a modest reset in FY26-28 earnings trajectory. We reduce FY26E/27E/28E EBITDA by 4%/13%/10% and cut our TP to INR 195 from INR 232, while maintaining Accumulate given some regulatory support and steady long-term CGD penetration opportunity.

Higher realization drives PAT: Q3FY26 adjusted PAT stood at INR 3.8bn (Elara: INR 3.4bn), up 33% YoY, on account of 33% growth in EBITDA/scm margin (up 12% QoQ). On QoQ basis, reduction in gas cost led to higher EBITDA margin, and thus 13% QoQ EBITDA growth. EBITDA was INR 5.0bn against our estimate of INR 4.8n, up 38% YoY. Opex/scm was down 1% YoY. Q3 blended realization was up 5% YoY (flat QoQ) due to higher CNG as well as domestic PNG prices. The cost of natural gas increased 2% YoY (down 2% QoQ) with shortfall in APM allocation compensated by higher-priced LNG or new well gas.

CNG volume growth at 10%, excluding DTC impact: Volume growth remains weak as volume increased 3% YoY to 9.4mmscmd (Elara: 9.6mmscmd), versus growth in range of 11-17% YoY during pre-Covid quarters of Q1FY17-Q3FY20. CNG volume growth was at 3% YoY to 6.9mmscmd. Ex-DTC impact, volume growth was 10%. Industrial PNG volume was up 3% YoY to 1.2mmscmd and domestic PNG volume rose 8% YoY to 0.8mmscmd.

International foray, an optional value in future: IGL is evaluating a CGD opportunity in industrial cities of Saudi Arabia. While these are at early stage, management indicated that incremental capex there could be ~INR 5-8bn. Visibility on timelines is contingent on bid outcomes and regulatory terms, and the Saudi Arabian foray should be viewed as a strategic option rather than a near-term earnings driver.

Retain Accumulate with a lower TP of INR 195: We reduce our FY26E/27E/28E EBITDA by 4%/13%/10% and cut our TP to INR 195 from INR 232, as EBITDA/scm margin remains below the company’s target of INR 7-8/scm, and the pace of recovery is slow. However, we maintain Accumulate given some regulatory support and steady long-term CGD penetration opportunity. We assume EBITDA/scm in FY27E and FY28E at INR 7.1-7.4 (from INR 7.9-8.1).

We roll-over TP to FY28E estimates. Our DCF-based TP assumes long-term EBITDA/scm margin of INR 7.4 (from INR 8.0), with a 6.9% volume CAGR (from 8%) in FY25-29E and 11.6% WACC (unchanged).

Please refer disclaimer at Report

SEBI Registration number is INH000000933