Hold Automotive Axles Ltd For the Target Rs. 1,975 By the Axis Securites

Recommendation Rationale

Industry Outlook: We expect the M-HCV market volumes to marginally decline YoY in FY25 (~400,000 MHCV volumes). As per the management, Q4FY25E is expected to perform better sequentially with ~1,10,000 MHCV units (largely flat YoY). For FY26E, we expect low single-digit growth in the MHCV segment

Long-term growth drivers: (1) Product diversification to new bus axles (expect axles for 13.5/15 mt buses to begin commercial production by FY26E post final trials by the end-user OEMs) (2) electric vehicle (EV) axles (3) Increased export share post plant modernising (expect parent Meritor to play a vital role). (4) Expansion of the aftermarket business.

EBITDA Margins: Based on the above growth outlook, we expect the company's longterm EBITDA margin to reach 12-13% by FY28/29E, an increase from the current 10- 11%. The company will primarily drive this by taking initiatives in Lean Manufacturing, Cost Optimization, and supplier consolidation. Based on the above growth outlook, we expect the company's longterm EBITDA margin to reach 12-13% by FY28/29E, an increase from the current 10- 11%. The company will primarily drive this by taking initiatives in Lean Manufacturing, Cost Optimization, and supplier consolidation.

Company Outlook & Guidance: Based on strategic long-term growth drivers, the company aims to double its top-line revenue and achieve a CAGR of 14-15% over FY24- 29. This expansion is expected to lead to higher revenues and a gradual improvement in EBITDA margins, driven by more efficient resource utilisation

Current Valuation: 17x FY27 EPS (unchanged)

Current TP: Rs 1,975/ share (unchanged)

Recommendation: We maintain a BUY rating with a 13% upside potential

Financial Performance: Automotive Axles Q3FY25 revenue (inline) remained largely flat YoY but increased by 7% QoQ. EBITDA (inline) came in at Rs 57.5 Cr, flat YoY but up 12% QoQ, primarily driven by lower other expenses, partially offset by higher estimated personnel costs. PAT stood at Rs 39.6 Cr, flat YoY and up 10% QoQ, beating estimates by 5%, largely due to higher non-operating income and lower-than-estimated depreciation.

Outlook: The CV industry has experienced higher tonnage growth over the last two years despite production volumes remaining below the peaks of FY19. Looking ahead, we anticipate marginal growth in the goods carrier segment in FY25E due to the high base of FY24, while the passenger carrier CV segment is expected to achieve high single-digit growth. We forecast an EBITDA CAGR of 3% for FY24-27E, supported by new product launches and cost control efforts, assuming similar commodity price levels.

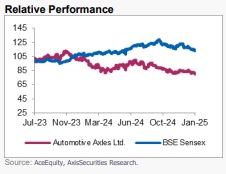

Valuation & Recommendation: The near-term outlook for the CV industry remains cautious; however, increased government infrastructure spending is expected to benefit the sector in the long term. As a proxy to the MHCV industry, we see limited downside risk for AutoAxles at the current market price. Therefore, we maintain a BUY rating at 17x FY27 EPS (unchanged) with a target price of Rs 1,975 per share, implying a 13% upside from CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633