Reduse PSP Projects Ltd For Target Rs. 720 By Choice Broking Ltd

Recent Share Price Rally Provides an Attractive Exit Opportunity

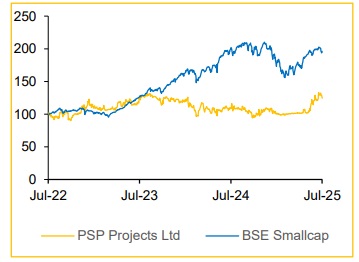

We downgraded PSP Projects Ltd. (PSPPL) from BUY to ADD in our Q4FY25 update on May 26, 2025 with a forecast upside of 12%. Ever since, the stock has rallied by 20% in anticipation of large order wins from the Adani Group. We maintain our TP of INR 720/sh for PSPPL, which implies a downside of 8% from CMP. Hence, we downgrade PSPPL to REDUCE from ADD earlier.

Our core investment thesis on PSPPL remains unchanged: With the advent of Adani Group entity (Adani Infra) as a promoter shareholder via the SPA & Open Offer deal (details mentioned below), we believe there is better order book visibility but margin compression ahead. We are not too excited with the way the deal has been structured – promoter (Mr. Prahladbhai S Patel) selling a sizeable stake (upto 30% shareholding which is about 50% of his stake) to Adani Infra while minority shareholders did not get an attractive deal.

PSPPL management has indicated that business from the Adani Group will be executed on a cost plus basis. Adani Group is a cost champion and would strive to get the best deal for their shareholders, which implies potential pressure on PSPPL’s margins, in our view.

In this kind of a structure, the lucrative upside optionality in PSPPL stock is automatically traded off for downside protection, which makes the stock now behave more like a fixed income instrument, in our view.

We would consider reviewing our outlook on PSPPL with a more constructive lens if there is credible evidence that PSPPL receives higher volumes of higher margin business from the Adani Group (vs. other market opportunities).

Valuation:

We now also take a more holistic approach to valuing PSPPL and incorporate a DCF based model (10 year explicit forecast period upto 2035E and terminal growth rate of 2%) which yields a TP of INR 720/share. Risks to our rating include large volumes of high margin deal wins from the Adani group, PSPPL demonstrates evidence that they are willing to forego deals from the Adani Group for more lucrative outside opportunities.

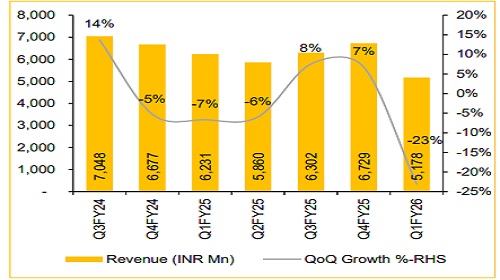

Q1FY26: Disappointing Performance Overall

* PSP Projects Ltd. reported Q1FY26 consolidated revenues at INR 5,178Mn, down 17% YoY and up 23% QoQ well below CIE estimates at INR 6,645Mn. Revenue decrease was due to labor shortages and delays in project execution, due to early monsoon season in Gujarat and seasonal factors such as wedding season and post-march migration.

* EBITDA for Q1FY25 was reported at INR 248Mn, down 66% YoY and 23% QoQ vs CIE estimates at INR 565Mn. Q1FY25 EBITDA Margin came in at 4.8% vs 11.9% in Q1FY25 and 4.8% in Q4FY25.

* Adjusted PAT for Q1FY26 stood at INR 3.7Mn, down 99% YoY and 93% QoQ vs CIE estimates at INR 233Mn. Q1FY 26 APAT Margin came in at 0.1% vs 5.6% in Q1FY25 and 0.9% in Q4FY25.

* Current orderbook stands at INR 65,140Mn, which is down 10.3% QoQ and is 2.6 times FY25 Revenue. Orderbook as of Q4FY25 was INR 72,660Mn.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131