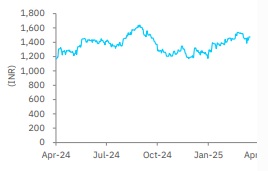

Accumulate Cholamandalam Investment & Finance Company Ltd For Target Rs. 1,618 By Elara Capital

Business mix management aids asset quality

While Cholamandalam Investment and Finance’s (CIFC IN) Q4 earnings stood ahead of expectations, largely driven by higher-than-anticipated business growth (30% YoY) that in turn percolated into robust topline, segmental asset quality remained unimpressive. LAP and home loan (HL; 32.4% of AUM), key growth drivers, are expected to normalize as portfolios reach maturity. Credit costs dropped 14bps sequentially, on denominator effect as headwinds in vehicle finance (VF) and unsecured business remain pressing. Even as the rally in the past three months (up 23%) was pronounced, we believe 4x forward P/ABV is a fair value multiple for a business such as CIFC with sizeable share of cyclical VF business. Nimble business mix realignment across credit cycles positions CIFC favorably versus peers. Hence, we reiterate Accumulate for a raised TP of INR 1,618.

PAT beat led by cost control and stable margins: PAT came in at INR 12.7bn (beat on estimates), up 16.6% QoQ/19.7% YoY, as opex remained flat QoQ and on a 5.8% QoQ drop in provisions. Lower opex helped the cost-income ratio improve by 194bps QoQ to 38%, boosting PPoP by 9.6% QoQ/43.2% YoY. NIMs were largely steady at 8.2% and should improve going forward, as 20% of the borrowings, linked to repo and T-bill rates, are being repriced, with a 10-15bps reduction in cost of borrowings anticipated in FY26E.

Traction in non-vehicle business continues to aid growth: Disbursements grew 2.4% QoQ/6.6% YoY, and AUM rose 5.8% QoQ/26.9% YoY, led by LAP (up 10.3% QoQ/38.8% YoY) and HL (up 7.6% QoQ/37.5% YoY). New business growth moderated in FY25 following the FinTech exit in CSEL and the curtailment of supply chain finance in SME but may normalize by Q3- Q4FY26. VF growth has slowed to 4.7% QoQ/19.8% YoY as LAP (22.4% of AUM) and HL (10% of AUM) inch up. We forecast a 20% AUM CAGR in FY26E-28E for CIFC.

Mix rejig aids asset quality: GS3 improved by 10bps QoQ to 2.81%, while credit costs stood at 1.3% (-10bps QoQ). VF credit cost at 1.2% improved a sharp 50bps QoQ and is expected to reduce further by 20bps in FY26E, aided by monsoon outcomes and improving capacity utilization, which picked up from Q3. However, CSEL and SME credit costs spiked by 140bps/60bps QoQ to 7.1%/1.4%, respectively. HL witnessed a 30bps uptick while LAP was stable. In line with guidance, we maintain credit cost estimates at 1.4% in FY26E-28E.

Maintain Accumulate: Q4 earnings were mixed for CIFC. While continued home loan growth led by capacity expansion lifted the core, the asset quality metrics indicate room for improvement. Modelling in this scenario, we raise FY26E PAT estimates by 3% and cut FY27E PAT estimates 5%. We also introduce FY28E. Given increased focus on business expansion in secured lending, normalized RoAs will now be capped in the range of 2.3-2.4% and RoEs within 20-21% in FY26E-28E. Attributing multiple expansion to CIFC’s nimble business mix management (combatting cyclicality) and post the recent rally (up 23% in past three months), we raise target multiple to 4.6x, to arrive at a TP of INR 1,618 (from INR 1,434). Reckoning 4.5- 4.6x as fair value multiple for CIFC’s business model, we foresee 6% incremental potential upside from the current levels. Hence, reiterate Accumulate.

Please refer disclaimer at Report

SEBI Registration number is INH000000933