Hold Coal India Ltd for the Target Rs.362 by JM Financial Services Ltd

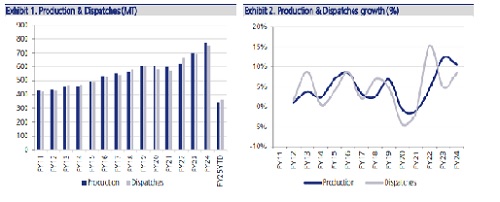

“King coal is coming back," we had said in Sep’23. Since then much water has flown under the bridge. The geopolitical landscape is tense but not disruptive, power demand is growing but less than renewable energy generation, and thermal capacity expansion for energy security is back on the table but with reduced utilisation rates. After showing remarkable performance (production and dispatch, both grew 10%+ YoY during the last 2 years vs. historical average of 3-4%), Coal India has now set an aspiration to reach 1bn tonnes (BT) of production by FY27 (which we believe will now happen by FY30). Amidst these factors, the slow and steady change in production mix towards inferior and cheap coal, gradually reducing PLF of thermal power plants, rise of captive mining, moderating/ stable e-auction prices, unlikely success in substitution of imported coal and lack of any meaningful impact from new thermal power plants is likely to limit the company’s performance momentum in the next few years, resulting in EPS cut by 9-13% during FY25-27E from our earlier estimates. During FY24-30, we estimate Coal India to register revenue/ ex-OBR EBITDA/ PAT CAGR of 4%/ 1% /-1% vs. 8%/ 18%/ 25% during FY18-24. Hence, we downgrade the stock to HOLD with a revised DCF-based TP of INR 362 implying 3.7x EV/EBITDA FY27.

? Coal quality; less discussed but high impact factor: Coal quality is determined by its gross calorific value (GCV), basis which it is graded, and priced, from G-1 (7,000 kCal/kg) to G17 (2,200-2,500 kCal/kg). Currently, G-1 is priced at INR 8,899 per tonne while G-17 is at INR 732 per tonne. Net realisation has been largely stable in recent years. Most of Coal India’s (CIL) non-coking coal output is from low grade G11-G13, with G-11 contributing the maximum. Over the years (FY20-24), production of low grade coal has been increasing faster than others. The 226MT of incremental production over FY24 production to achieve the 1BT target will constitute 206 million tonnes (MT) of inferior and, hence, the cheapest G-11 to G-14 grade coal from subsidiaries – CCL, SECL and MCL – which will increase pressure on net realisation.

? The writing is on the wall: Historically, thermal power plants have been operating at a PLF of more than 70% with some of the pit-head and well-maintained plants running at more than 80%. Today, Coal India is bound by long-term supply commitments for 583.4MTPA through fuel supply agreements (FSAs) with power plants (at 85% PLF). The average PLF of the total installed coal capacity of 235GW is estimated to be 58.4% in FY27 and 58.7% in FY32 as per CEA (Central Electricity Authority). Initial signs of this are already visible with thermal generation declining sharply during peak-renewable generation months (Exhibit-17).

? Rise of captive mining: As on now, the total number of coal producing mines in India are 408, out of which 26 are operated by private companies most of which are thermal coal mines. During Apr-Oct’24, 96MT of coal has been produced from commercial coal blocks, and that is expected to exceed 160MT in FY25. NTPC produced 34.39MT coal, +48% YoY in FY24, and is targeting to produce 86MT in the near future. Similarly, JSW Energy recently bagged one coal block in Odisha with reserves of 1,600MT for G-11 grade noncoking coal. The government aims to produce 320MT from captive and commercial blocks by 2030. We expect commercial/ captive mining to gain traction and achieve the FY30 target, which is a direct loss of opportunity for Coal India. (Exhibit-25).

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361