Buy HCL Technologies Ltd for the Target Rs. 1,760 By Prabhudas Liladhar Capital Ltd

Beat on result, investing for AI led growth…

Quick Pointers:

* Revised Service guidance to 4-5% CC revenue growth (earlier 3-5%) & maintained consolidated revenue & EBIT margin guidance

* Strong Deals wins of USD 2.57 bn compared to USD 1.8 bn in Q1

The revenue growth performance was ahead of our estimates, attributed to the uptick in IT Service business (+2.6% QoQ CC) & part of the ER&D service growth (+2.2% CC QoQ) which was led by 2-month integration of HPE. Services business outperformance further de-risks the odds of achieving the upper end of the guidance band (4-5% YoY CC). The broad-based growth along with robust deal TCV is largely a function of revenue cannibalization from legacy opportunities to advanced AI-led spending. The growth was largely driven by short-burst deals and lower client pyramids, the growth within top 10 accounts was below company growth at 1.5% QoQ. The management is doubling down on AI strategy and striving IP-led revenue opportunities, the early success from experimentation to production-grade is reflecting in the revenue generated (USD100m) through Advanced AI. The focus is to be asset-light and building a layer of AI Engineering on top. However, the new opportunities would require continued investments in R&D activities and IP accelerators. Additionally, the compensation revision in H2 would keep the margins under pressure. We are baking revenue growth of 4.4%/6.4%/7.5% YoY CC, while expecting adj. margins to be at 18.0%/18.3%/18.6% over FY26E/FY27E/FY28E, respectively. Considering the early green shoots in pockets beyond FS, and incremental traction around advanced AI, we are upgrading to BUY (earlier ACCUMULATE). The stock is currently trading at 22x and 20x FY26/FY27E EPS, we roll forward to Sep’27 EPS and assign 22x for a TP of 1,760.

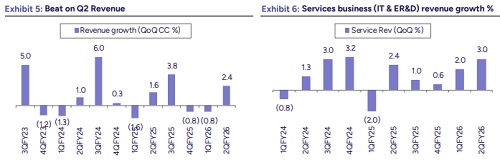

Revenue: HCLT delivered a strong Q2 performance, beating both our and Street expectations with 2.4% QoQ CC revenue growth (vs. 1.5% estimated). The Services business grew 2.5% QoQ CC, led by IT Services at 2.6% and ER&D at 2.2%. The P&P segment also surprised positively with 0.5% QoQ CC growth. Notably, the company disclosed its quarterly Advanced AI revenue for the first time, reporting USD 100 mn.

Margins: EBIT (ex-restructuring cost of 0.55%) came in at 17.9%, up 160 bps QoQ. Margin gains were aided by stronger P&P profitability (+35 bps), absence of Q1 one-offs (+30 bps), higher utilization (+50 bps) and currency tailwinds (+56 bps). IT Services and P&P margins expanded 120 bps and 410 bps QoQ, while ER&D declined 20 bps. Overall, Services (IT + ER&D) margin improved 90 bps QoQ.

Guidance: HCLT maintained its revenue guidance to 3-5% YoY CC for Consolidated business while for Services business it narrowed the guidance band to 4-5% CC growth from 3-5% given earlier. For FY26 company maintained its EBIT margin guidance of 17-18%.

Valuations and outlook:

We are baking in USD revenue/Earnings CAGR of 7%/10.2% between FY25-28E. We are assigning a PE multiple of 22x to LTM Sep. 27E earnings and arrive at a TP of INR 1,760. We upgrade our rating on the stock from Accumulate to BUY

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271

.jpg)