Neutral Anand Rathi Wealth Ltd for the Target Rs. 2,800 by Motilal Oswal Financial Services Ltd

Consistent performance across market cycles

* Anand Rathi Wealth (ARWM) reported operating revenue of ~INR3b in 2QFY26 (in line), up 23% YoY/9% QoQ, primarily driven by 28% YoY growth in revenue from the distribution of financial products and 16% YoY growth in MF revenue. For 1HFY26, it grew 19% YoY to INR5.7b.

* Operating expenses rose 16% YoY and 9% QoQ to INR1.6b, driven by 14%/21% YoY increase in employee/other expenses. Improved operational efficiency resulted in EBITDA of INR1.4b, up 32% YoY and 8% QoQ (in line), with EBIDTA margin at 46.2% vs. 42.9% in 2QFY25. For 1HFY26, EBITDA grew 31% YoY to INR2.7b.

* For 2QFY26, PAT stood at INR999m, up 31% YoY/6% QoQ (in line). PAT margin expanded by 215bp YoY to 33.6% (est. 34.7%). For 1HFY26, PAT grew 30% YoY to INR1.9b.

* Management remains confident of sustaining 20-25% growth, supported by low RM and client attritions and existing RM capacity per AUM. It is targeting minimum PBT/PAT margins of ~40%/~30%, led by continued reinvestment in technology, talent, and operational efficiencies.

* We expect a CAGR of 25%/22%/27% in AUM/revenue/PAT during FY25- 28E, with robust cash generation (INR12.8b of OCF during FY25-28E), RoE of 37%+, and a healthy balance sheet. We reiterate our Neutral rating with a one-year TP of INR2,800 (premised on 42x Sep’27E EPS).

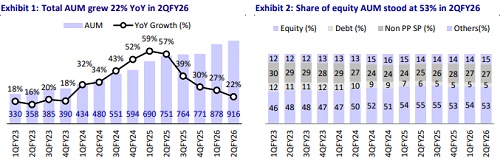

AUM growth backed by MF flows; maintains guidance

* Total AUM grew 22% YoY to INR916b, led by steady strong inflows and an increase in the ticket size of clients. The share of equity MFs in the AUM mix stood at 53%, with equity AUM market share rising to 1.43% in Sep’25 from 1.02% in Mar’19. Private Wealth/Digital Wealth AUM grew 22%/21% YoY to INR894b/INR22b.

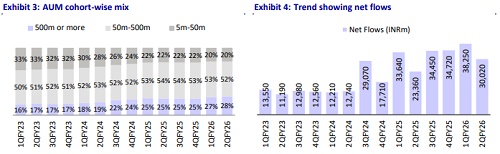

* Total quarterly net inflows rose 29% YoY to INR30b, while equity net flows jumped 101% YoY to INR20.6b. For 1HFY26, equity flows grew 30% YoY. Equity inflows as a proportion of total stood at 70% vs. 52% in 2QFY25, driven by higher allocations amid declining markets.

* Monthly SIP flows for Sep’25 increased 37% YoY to INR800m.

* The share of customers with AUM of INR500m+ has increased to 28% in 2QFY26 from 25% in 2QFY25. It onboarded 451 net new client families in 2Q, taking the total count to 12.8k families.

* Operating expenses grew 16% YoY, while the cost-to-income ratio (CIR) improved to 53.8% in 2QFY26, compared to 57.1% in 2QFY25.

* Other income increased 37% YoY but declined 4% QoQ to INR98m. For 1HFY26 it grew 34% YoY to INR201m.

* The company reported one of the lowest client attrition rates in the industry, with only 0.09% of AUM lost in 2QFY26 vs. 0.18% in 2QFY25. RM attrition remained minimal, with two exits during the quarter. About 82% of AUM associated with the RM attrition has been retained.

* AUM per RM increased to INR2.3b in Sep’25 from INR2b in Sep’24, driven by continued association of RMs with the organization. Additionally, clients per RM improved to 33 from 29 in 2QFY25.

Highlights from the management commentary

* Revenue mix currently stands at 40-41% for MF and 60% for Structured Products, with a target of gradually achieving a 50:50 balance over time.

* In terms of revenue, PAT, and AUM guidance for FY26, the company has already achieved 50.3%, 52%, and 92%, respectively, as of 1HFY26. The company did not revise its AUM guidance.

* Diversification initiatives are planned and will be addressed in due course.

Valuation and view

* ARWM is one of the few companies in the listed space that has consistently outperformed its stated guidance. For FY26, management has guided for revenue/PAT of INR11.8b/INR3.8b vs. our estimates of INR11.7b/INR3.9b.

* We expect a CAGR of 25%/22%/27% in AUM/revenue/PAT during FY25-28E, with robust cash generation (INR12.8b of OCF during FY25-28E), RoE of 37%+, and a healthy balance sheet. We reiterate our Neutral rating with a one-year TP of INR2,800 (premised on 42x Sep’27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412