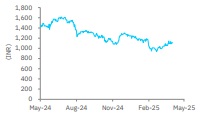

Accumulate Birla Corporation Ltd For Target Rs. 1,502 By Elara Capital

Gearing for next phase of growth

Birla Corporation (BCORP IN) reported a sharp ~13% YoY and ~115% QoQ increase in EBITDA to ~INR 5.4bn, ahead of our and consensus estimates of ~INR 3.8bn and ~INR 3.9bn, respectively, driven by better-than-expected volume, realization and higher incentive income accrual. EBITDA/tonne for Cement rose INR 445 QoQ. We believe a recovery in cement demand and prices, continued incentive income, and cost efficiency measures will help BCORP’s near-term performance. Additionally, recently announced capacity expansion projects, which are set to be commissioned in phases by FY29, enhance long-term growth visibility, which should have a favorable impact on the valuations. Thus, we reiterate Accumulate with a higher TP of INR 1,502, based on March 2027E EV/EBITDA.

Better prices in East and North India lead to margin improvement: Cement sales volume grew ~8% YoY and ~17% QoQ to ~5.2mn tonnes, ~5% ahead of our estimates. Blended realization was down ~2% YoY but rose ~7% QoQ to INR 5,362/tonne, ~4% ahead of our estimates. Cement realization was down ~1% YoY but rose ~7% QoQ to INR 5,103/tonne. Blended operating cost declined ~3% YoY and QoQ each to INR 4,345/tonne. The QoQ decline was primarily due to reduced power & fuel cost and operating leverage benefits. As a result, EBITDA/tonne for cement jumped ~5% YoY and ~78% QoQ to INR 1,014. Blended EBITDA/tonne grew ~4% YoY and ~85% QoQ to INR 1,017, versus our estimate of INR 761.

Capacity to reach 27.6mn tonnes by FY29: Work on the previously announced 1.4mn tonnes cement capacity expansion at Kundanganj (Uttar Pradesh) is on track and should be completed by Q2FY26. Also, BCORP has announced ~INR 43.3bn investment towards expansion projects, comprising: 1) 2.8mn tonnes grinding unit at Gaya (Bihar), 2) 3.7mn tonnes clinker unit at Maihar (Madhya Pradesh), and 3) 1.4mn tonnes and 2.0mn tonnes grinding units at Prayagraj (Uttar Pradesh) and Aligarh (Uttar Pradesh), respectively. Post completion of these projects, cement capacity will rise from the current 20.0mn tonnes to 27.6mn tonnes by FY29.

Jute division – EBIT margin turns positive: The jute division reported positive EBIT margin in Q4 after three consecutive quarters of negative EBIT margin. It reported a positive EBIT margin of 2.5% in Q4FY25 versus 5.7% in Q4FY24 and a negative EBIT margin of 5.4% in Q3FY25. It reported a cash profit of INR 44.3mn in Q4 versus a cash loss of INR 46mn in Q3.

Reiterate Accumulate, TP raised to INR 1,502: We believe limited presence in surplus market of South India, continued incentive income, focus on premiumization, and saving from coal mines bode well for long-term performance. Also, recently announced growth capex projects strengthen long-term growth visibility. We introduce FY28E and raise our EBITDA estimates ~7% each for FY26E-27E. So, we raise our TP to INR 1,502 from INR 1,350, based on 8x (unchanged) March 2027E. Sub-par demand, weak cement prices and a sharp rise in fuel prices are key risks to our call. We reiterate Accumulate.

Please refer disclaimer at Report

SEBI Registration number is INH000000933