Buy Aurobindo Pharma Ltd for the Target Rs. 1,300 By Prabhudas Liladhar Capital Ltd

In line EBITDA; US sales to pick-up

Quick Pointers:

* Reiterate margin guidance of 20-21% in FY26

* PenG yield improving, capacity now at 40-50% levels.

Aurobindo Pharma’s (ARBP) Q2FY26 EBITDA of Rs16.8bn (up 7% YoY), was in line with our estimate. The company has maintained its 20-21% OPM guidance for FY26E. We expect US sales and margins to improve from H2FY26/FY27 with ramp up in PenG facility, Vizag pant commercialization and launches in US. We believe ARBP has multiple growth drivers in place with investments in vaccines, injectables, biosimilars and PLI which are expected to be reflected from FY26. Our FY26 and FY27E EPS stands reduced by 2-3%. The stock is currently trading at 8.6x EV/EBITDA and 15.5x P/E on FY27E. We maintain our “Buy” with TP of Rs1,300/share; valuing at 17x Sept2027E EPS.

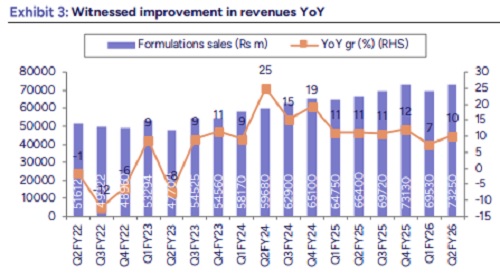

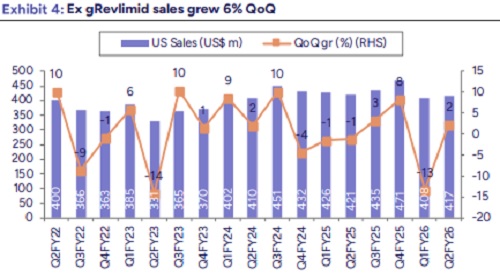

* Revenue growth aided by EU and ARV segment: Overall Revenue came in at Rs83bn, up 6% YoY, (we est Rs 82bn). US revenues stood at $417mn, up 2% QoQ and down 1% YoY (we est $420mn). Mgmt cited ex gRevlimid S sales were up 6% QoQ. EU sales up 18% YoY to Rs 24.8bn, beat our est. ARV formulations also came in higher up 68% YoY to Rs 3.3bn. RoW business was up 9% YoY. API sales declined 17% YoY.

* EBITDA in line; higher tax led to PAT miss: Gross margins remain healthy at 59.7% (up 90bps QoQ and YoY). R&D spent stood at Rs 4.1bn (5% of revenue), up 1% YoY. Other expenses ex R&D were up 10% QoQ. Resultant EBITDA margins came in at 20.3% flat QoQ. EBITDA came at Rs16.8bn (up 7% YoY); in line with our estimate. Tax rate came in higher at 34%. Resultant PAT at Rs8.5bn; 9% below our est.

Key Conference Call Takeaways

* US: Growth was led by base business volumes and new launches. Six launches were made during the quarter. Filed 13 ANDAs and received 7 approvals. Injectable sales were up 6% QoQ, pre disruption levels expected within 1-2 quarters. Oncology oral solids from Eugia 1 to drive near term launches. Price erosion remained low single digit.

* Europe: Strong traction across France, Portugal, Netherlands and Germany. On track to surpass EUR 1bn annual revenues by FY26E. Injectables account for 10% of EU sales with margins in high teens. Targeting 20%.

* Growth markets: Growth witnessed across regions. ARV formulations up YoY on higher tender volumes. China OSD facility nearing breakeven by Q3- Q4FY26 with capacity ramp up to 2bn units.

* Pen-G facility commissioned in Jul’25. Operated at 40–50% capacity (6,000 MT annualized); yields improving. Breakeven expected once utilization rises to ~800 MT/month. Company has sought Minimum Import Price from govt to aid scaling to 15,000 MT.

* Vizag: Several new injectable launches expected post-clearance of Eugia-3 facility. Vizag also part of specialty/oncology oral solids network (launches lined up for Q4 FY26–Q1 FY27).

* Biosimilars and Vaccines: First EU biosimilar batch dispatched; commercial supplies to start Mar’26. Expect seven and two biosimilar approvals across EU & US markets by FY27-28. Expanded collaboration with MSD by signing second product with 15 KL bioreactor lines block added under same facility. USFDA’s new draft guidance reducing comparative efficacy requirement seen as favourable. Denosumab: Phase 3 successful; EMA filing by Apr’26, USFDA filing by Jul’26. Omalizumab: Phase 3 complete; EMA filing Jun–Jul’26, US a quarter later. Tocilizumab: EMA granted Phase 3 waiver; filing by Jul’26. Bevacizumab (Bevqolva): Approved in UK; EMA filing by Apr’26; USFDA filing by end-2026.

* Capex at $ 106 mn spend towards capability enhancements, new business developments. Ongoing projects: TheraNym biologics facility (Rs 10bn) o commission Jun–Jul’26. No major new greenfields planned; focus on biologics, automation & compliance.

* Other highlights: Maintained EBITDA margin guidance at 20–21% for FY26E. Pen-G, biosimilars, injectable scale-up, and China ops to drive next-2-year growth. USFDA reinspection for Eugia-III awaited; multiple launches contingent. Confident of sustaining double-digit growth in EU; China to turn profitable in H2. Company reiterates disciplined capital allocation; large M&A only if strategically accretive. Net cash inflow of $57 mn; net cash position improved to $170 mn. Average finance cost declined to 4.7%.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271

.jpg)