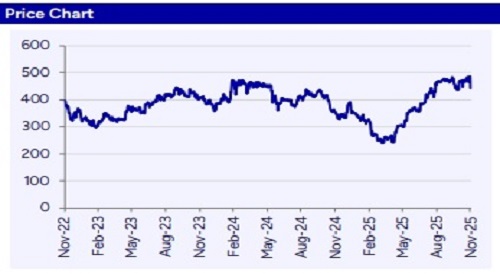

Accumulate Delhivery Ltd for the Target Rs. 489 By Prabhudas Liladhar Capital Ltd

B2C and PTL margins disappoint

Quick Pointers:

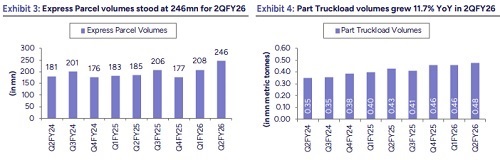

* B2C shipment volumes increase 33.0% YoY to 246mn led by consolidation of E-com express.

* Integration cost pertaining to E-com acquisition was Rs Rs900mn in 2QFY26.

We have subsumed E-com express into our P&L from 2QFY26 as this was the maiden quarter of consolidation. As a result, our valuation framework and estimates have undergone significant changes. Refer section titled “Key changes in estimates & valuation” in our report for more details.

Adjusting for the integration cost charge of Rs900mn arising from acquisition of E-com express, DELHIVER IN’s operating performance was better than our estimate with EBITDA margin of 6.2% (PLe 5.9%). Improvement was driven by turn-around in SCS division with service EBITDA margin of 12.9%. However, service EBITDA margin of B2C parcel division expanded by just 20bps YoY to 15.1% and operating leverage benefit was not evident as yields were down 6.7% YoY to Rs65.5 given average weight per parcel on E-com’s network is comparatively lower. In addition, PTL division’s service EBITDA margin also witnessed a sequential dip to 8.5% as fixed cost absorption was weak amid delay in shipments post changes in GST rates. Nonetheless, service EBITDA margin of B2C parcel division is expected to revert to ~16-18% mark by end of FY26E. PTL division’s service EBITDA margin is also expected to mimic B2C parcel division over the next 2 years. Overall, we expect sales CAGR of 14% over the next 3 years with EBITDA margin of 5.1%/9.4%/10.2% in FY26E/FY27E/FY28E and maintain ACCUMULATE with a TP of Rs489 (38x SepFY27E EBITDA; no change in target multiple).

Key changes in estimates & valuation: In 2QFY26, integration cost charge arising from acquisition of E-com express was Rs900mn and the aggregate cost is likely to be lower than the initial guidance of Rs3,000mn. As an additional charge of Rs1,000-1,100mn is expected over the next 2 quarters, we are factoring a one-time cost hit of Rs2,100mn in our P&L for FY26E. Consequently, our reported PAT for FY26E stands at Rs1,359mn (earlier estimate of Rs3,582mn). However, given the nature of expense (non-recurring in nature), our adjusted PAT estimate stands at Rs3,459mn.

Key changes in estimates & valuation: In 2QFY26, integration cost charge arising from acquisition of E-com express was Rs900mn and the aggregate cost is likely to be lower than the initial guidance of Rs3,000mn. As an additional charge of Rs1,000-1,100mn is expected over the next 2 quarters, we are factoring a one-time cost hit of Rs2,100mn in our P&L for FY26E. Consequently, our reported PAT for FY26E stands at Rs1,359mn (earlier estimate of Rs3,582mn). However, given the nature of expense (non-recurring in nature), our adjusted PAT estimate stands at Rs3,459mn.

Erstwhile, we were valuing DELHIVER IN on SoTP basis with E-com express being valued separately. As we have now subsumed E-com express into our projections, we value the consolidated business (DELHIVER IN + E-com express) at 38x Sep27E EBITDA. There is no change in our target multiple, but we have excluded the per share value of E-com express from our valuation matrix.

Revenue grew 16.9% YoY: Revenue grew by 16.9% YoY to Rs25,593mn in 2QFY26 (PLe Rs25,182mn). B2C segment’s volume increased 33.0% YoY to 246mn (PLe 231mn) in 2QFY26 while realization was down 6.7% YoY to Rs.65.5/parcel. Consequently, B2C revenue increased 24.1% YoY to Rs.16,110mn (PLe Rs15,560mn). PTL segment saw volume/revenue growth of 11.7%/15.2% YoY to ~0.48mmt (PLe 0.50mmt)/Rs5,460mn (PLe Rs5,581mn) in 2QFY26, while the realization improved marginally by 3.1% YoY to Rs11,447/ton. Supply chain services (SCS) revenue was down 13.7% YoY to Rs1,700mn in 2QFY26. FTL revenue was down 5.1% YoY to Rs1,500mn while cross border revenue decreased 35.6% YoY Rs380mn.

EBITDA margin at 2.7%: EBITDA increased 19.0% YoY to Rs682mn. Adjusting for the one-off integration cost of Rs900mn pertaining to acquisition of E-com express, EBITDA stood at Rs1,582mn (PLe Rs1,486mn). Loss for the quarter stood at Rs505mn. After adjusting for the integration cost, PAT stood at Rs395mn for 2QFY26. Service EBITDA margin for B2C parcel/PTL/SCS division stood at 15.3%/8.5%/12.8% in 2QFY26.

Con-call highlights: 1) Delhivery processed over 100mn shipments in Sep’25 and achieved a peak of 7.2mn orders/day during the festive period. 2) PTL division is expected to achieve steady state service EBITDA margin of ~16-18% in 24 months. 3) SCS segment reported an EBITDA margin of 12.9% in 2QFY26 in comparison to (4.4%)/7.3% in 2QYF25/1QFY26 respectively reflecting a strong turnaround driven by calibrated focus on profitable contracts. 4) Rs900mn of integration cost was booked in 2QFY26 pertaining to the acquisition of E-com express. Breakup includes Rs310mn/Rs170mn/Rs210mn for premature facility exits/fulfilment centre closures/employee separation respectively and the balance for technology shutdown and other expenses. 5) Long term capex target is ~4% of revenue. 6) Delhivery’s Rapid Commerce business (2-hour same-day delivery) operates across Bengaluru, Hyderabad, and Chennai with 20 dark stores. The service has recently been expanded to NCR and slated for a launch in Mumbai by 4QFY26E. It represents a niche Rs800–1,000mn revenue opportunity. 7) Delhivery Direct (ondemand intracity service) operates in Ahmedabad, Bengaluru, and NCR, with plans to expand into 5 more cities (including Jaipur and Surat) by FY26E-end. It currently has annual run-rate of Rs250–300mn. 8) Steady state margin guidance for B2C express parcel segment remains intact at ~16-18%. 9) Corporate overheads rose from Rs2,090mn in 1QFY26 to Rs2,350mn in 2QFY26, mainly due to Rs150mn of higher technology costs, Rs20mn of additional gratuity provisioning, and Rs20mn of end-of-year bonus. 10) Before the acquisition, Ecom Express handled approximately 85–90mn orders/quarter on a steady-state basis. 11) A new subsidiary, Delhivery Financial Services, has been formed. The objective is to facilitate FASTag & fuel services to trucking partners and provide lending assistance to fleet owners (financial risk will not be DELHIVER IN’s books).

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271