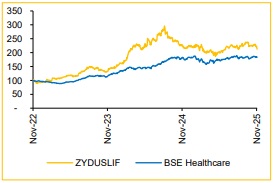

Add Zydus Lifesciences Ltd For Target Rs. 1,020 By Choice Broking Ltd

Growth Amid Margin Compression

FY26 Transitional Phase; Recovery to Begin FY27

While revenue is expected to sustain double-digit growth in FY26E, EBITDA margin are projected to contract meaningfully to 26% (vs. 30.4% in FY25) due to continued investments in pipeline expansion and an unfavourable product mix. Margin uptick hinges on new launche scale up. Revenue growth will be supported by an acceleration in US launch momentum, steady market share gains in Mirabegron, and continued outperformance in India.

We have marginally revised our estimates upward by 2.2%/2.1% for FY26E/FY27E. We value the company at 18x (unchanged) FY27-28E average EPS yielding in a revised TP of INR 1,020 (vs. INR 1,000 earlier) and upgrade our rating to ADD.

It is important to note that this excludes any potential impact from the planned INR 5,000 Cr fund raise, as the purpose and structure of the transaction remain unclear.

Strong YoY Growth; Margins Expand

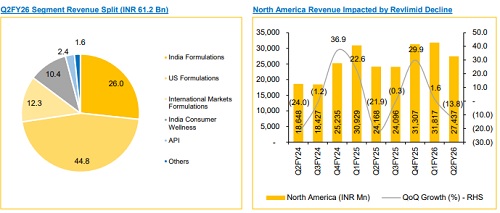

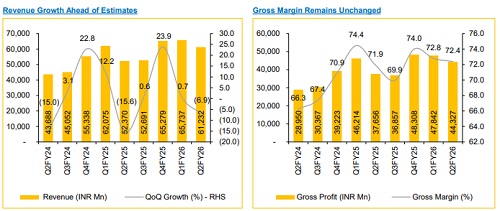

* Revenue grew 16.9% YoY but declined 6.9% QoQ to INR 61,232 Mn (vs. CIE estimate: INR 58,013 Mn).

* EBITDA grew 37.9% YoY but declined 3.5% QoQ to INR 20,158 Mn (vs. CIE estimate: INR 18,381 Mn); margin expanded 502 bps YoY / 115 bps QoQ to 32.9% (vs. CIE estimate: 31.7%).

* APAT increased 35.4% YoY but declined 15.9% QoQ to INR 12,336 Mn (vs. CIE estimate: INR 12,355 Mn).

Double-Digit Growth Intact, Led by India & North America

Overall revenue remained strong in Q2, and we expect FY26 growth to remain in double digits. We believe the bulk of the momentum will come from North America and India. In North America, launch activity is expected to accelerate in H2 (15+ launches planned), with Revlimid’s drag reducing from Q4 onward and steady market-share gains in Mirabegron. In India, growth is expected to continue outperforming the IPM, with management confident of being in the first wave of Semaglutide (GLP-1) launches. International Markets and Medtech (acquired from Amplitude) is also expected to deliver double-digit growth.

Pipeline Build-Up to Impact FY26 Margins, Recovery in FY27

While EBITDA margins expanded meaningfully in Q2, the FY26 guidance remains unchanged at ~26%, tempered by lower margins in the acquired Medtech business and higher R&D spends. Margin improvement is likely from FY27 onward, driven by scale-up of new launches, fading Revlimid impact, and cost-optimization initiatives.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131