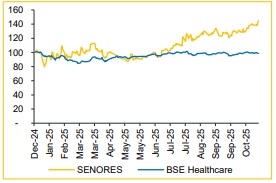

Buy Senores Pharma Ltd For Target Rs. 1,010 By Choice Broking Ltd

High-growth Trajectory Ahead

FY26 Growth Outlook Strengthens; PAT to Outpace Revenue on Leverage

SENORES remains in a high-growth phase, supported by a robust launch pipeline across regions and a continued ramp-up in injectables. Management expects ~50% revenue growth in FY26E and a 25–30% CAGR over FY25–28E, with ~100% PAT growth, with EBITDA margin in the range of 24-26%. We believe this will be driven by operating leverage from the scale-up of the new unit at its US facility, launches in high-margin CGT products and backward-integration benefits as the API facility becomes operational. We have revised our estimates upward by 2.6%/3.9% for FY26E/FY27E and value the stock at 30x the average of FY27–28E EPS. This results in a revised TP of INR 1,010 (vs. INR 960 earlier). The valuation is further supported by a PEG of 0.66x. We maintain our BUY rating.

Strong All-round Beat with Robust Growth and Margin Expansion

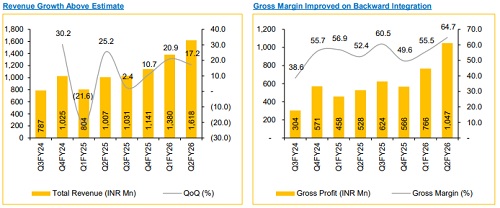

* Revenue grew 60.7% YoY / 17.2% QoQ to INR 1,618 Mn (vs. CIE estimate: INR 1,550 Mn).

* EBITDA grew 112.3% YoY / 44.9% QoQ to INR 495 Mn (vs. CIE estimate: INR 403 Mn); margin expanded 744 bps YoY / 585 bps QoQ to 30.6% (vs. CIE estimate: 26.0%).

* APAT increased 150.4% YoY / 63.9% QoQ to INR 324 Mn (vs. CIE estimate: INR 265 Mn).

Robust Growth Outlook; FY26 Revenue Set to Rise ~50%

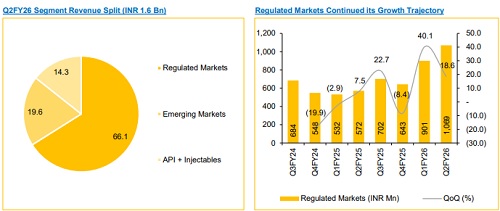

SENORES posted another quarter of exceptional growth, driven by regulated markets and the API + Injectables franchise. Management has guided for ~50% revenue growth in FY26, with a medium-term CAGR of 25–30%, which we believe will be supported by:

* Regulated Markets: We estimate ~60% growth in FY26, backed by multiyear visibility from new product launches (6-8 in H2), commercial rollout of acquired portfolios, and US capacity expansion (from 1.4 Mn to 2 Mn units).

* Emerging Markets: We expect ~20% growth, driven by an increasing mix of higher-value molecules and conversion of registrations to commercialisation (394 registered products). The segment has also turned cash-flow-ositive.

* Injectables: Rapid scale-up expected through hospital/HCP penetration, with focus on critical care products across legacy, in-licensed, and in-house developed portfolios.

Pipeline Build-up to Impact FY26 Margins, Recovery in FY27

EBITDA margin improved sharply in Q2, driven by a higher mix of own products and tighter cost controls. FY26 guidance remains conservative at 24–26%, with a further ~100 bps YoY improvement thereafter, with PAT expected to grow 100%. We believe this trajectory will be supported by benefits from backward integration, sustained growth in own-product contribution, and continued scale-up in the emerging markets business.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

.jpg)