Buy Vinati Organics Ltd for the Target Rs. 1,915 By Prabhudas Liladhar Capital Ltd

Lower Input Costs Fuel Margin Expansion

Quick Pointers:

* Phase 1 of ATBS capacity expansion commercialized this month, second phase to come online in April’26.

* Plants of products like 4MAP, TAA, PTAP are expected to be online in Q3FY26

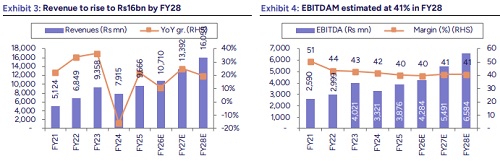

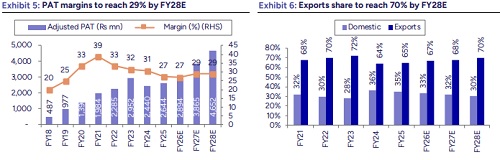

The company reported revenue of Rs5.5bn in Q2FY26, reflecting a modest 1.5% sequential growth, while remaining flat YoY. As per our discussion with management ~15% revenue growth in FY26 is achievable, primarily driven by volume expansion, with EBITDA margins expected to sustain at ~27%. Benefiting from the decline in raw material prices during H1FY26, margins expanded sharply by 590 bps to 29.9%. ATBS, the company’s flagship highmargin product, accounted for 35% of total revenue and remains oversold, supported by rising demand from the oil & gas sector where it is used as a tertiary oil recovery agent. Phase I of the ATBS capacity expansion has been commercialized this month and will support drive growth going ahead, while Phase II is expected to come online by April’26. The antioxidants segment contributed 12% to the overall revenue mix. New products such as MEHQ and Guaiacol, with a combined peak revenue potential of ~Rs4bn, did not contribute meaningfully in Q2 as samples are still being in approval phase. The ramp-up is expected to be gradual. Additionally, plants for upcoming products like 4MAP, TAA, and PTAP are expected to become operational in Q3FY26. The stock is currently trading at 40x FY27 EPS, we value the stock at 38x Sep’27 EPS and maintain BUY rating.

* Flat YoY revenue growth: Consolidated revenue stood at Rs5.5bn (0.6% YoY/ 1.5% QoQ) (PLe: Rs6.09bn), actual topline was higher than our estimates. H1FY26 revenue was 1.3% higher than H1FY25. Gross profit margin stood at 55.8% (vs 45.4% in Q2FY25 and 52.3% in Q1FY26), improving 350bps QoQ due to lower raw material costs. H1FY26 gross margin stood at 29.9% an increase of 590bps vs H1FY25.

* EBITDAM expanded to 30.4% in Q2FY26: EBITDA increased 25.1% YoY and 4.8% QoQ to Rs1,673mn (PLe: Rs1,862mn). EBITDAM stood at 30.4% (PLe: 30.5%) as against a margin of 24.2% in Q2FY25 and of 29.5% in Q1FY26, 90bps sequential increase. Reported consolidated PAT was at Rs1,149mn (10.1% YoY/ 10.3% QoQ), while margins were at 21% vs 19% in Q2FY25, respectively.

* EBITDAM expanded to 30.4% in Q2FY26: EBITDA increased 25.1% YoY and 4.8% QoQ to Rs1,673mn (PLe: Rs1,862mn). EBITDAM stood at 30.4% (PLe: 30.5%) as against a margin of 24.2% in Q2FY25 and of 29.5% in Q1FY26, 90bps sequential increase. Reported consolidated PAT was at Rs1,149mn (10.1% YoY/ 10.3% QoQ), while margins were at 21% vs 19% in Q2FY25, respectively.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271

.jpg)