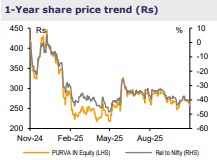

Buy Puravankara Ltd for the Target Rs.400 By Emkay Global Financial Services Ltd

Strong ramp up expected in H2

Puravankara (PL)’s pre-sales growth of 4% YoY to Rs13.2bn (in-line) in Q2FY26 largely came from sustenance sales; Thane projects provided growth delta as the West reported 150% YoY growth, albeit on a low base. Planned launch pipeline remains largely on track, and would open up Rs100-120bn inventory in H2FY26 which would, along with sustenance sales, drive a strong 36% presales CAGR during FY25-27E. The company has made strong progress on the business development (BD) front, adding Rs91bn GDV in H1FY26. Also, these being asset-light projects keep leverage under check vis-à-vis improving the growth visibility. More deals are expected ahead which would lead to growth continuity in the medium term. We maintain BUY on the stock with TP of Rs400.

In-line pre-sales; Thane project provides growth delta

PL’s Q2FY26 pre-sales grew 4% YoY to Rs13.2bn (in-line), which is resilient, as the performance is largely on the back of sustenance sales. The growth was supported by the Thane project, which propelled 150% YoY growth in western-region sales to Rs3.6bn. Sales in the South declined 15% YoY to Rs9.6bn, due to no new launches during the quarter. Consequently, the share of Mumbai and Pune in the value mix increased to 25% in H1FY26 (vs 15% in FY25). Collections grew 8% YoY to Rs10.5bn in Q2FY26.

Impressive progress on asset-light project additions, with focus on the West

PL made strong progress on the BD front as it acquired four projects that offer Rs91bn GDV potential. Of these, two projects with Rs48bn GDV were added in Mumbai (one redevelopment project each, in Malabar Hill and Chembur). The other two projects with Rs43bn GDV were in Bengaluru on JV/JDA basis. We expect more deal closures in Mumbai and Pune in coming quarters; this would provide even better geographic diversification with higher focus on the West. Further, as these BD projects have been via the assetlight route, they would keep growth intact vis-à-vis leverage under check.

Launch pipeline remains healthy

The company’s launch for H2FY26 pipeline, worth Rs120bn, largely remains on track. It includes the much-awaited launches in Mumbai, wherein approvals for the Andheri project are largely received; approvals for the Thane new phase and Bandra projects are expected by Dec-end. We maintain pre-sales estimates of Rs71bn/Rs93bn for FY26E/27E, respectively. Further, with progress in construction activity and inflows from new presales, we expect collections at Rs46bn/Rs63bn in FY26E/FY27E, respectively.

We maintain BUY

We value the residential business at 6x embedded EV/EBITDA (EV of Rs106bn) and commercial business on 8.5% cap-rate (EV of Rs22bn). At net debt of Rs35bn (on Mar26E), we keep our SoTP-based target price unchanged at Rs400 and maintain BUY on the stock. At CMP, the stock is trading at 30% discount to the residential business NAV.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354