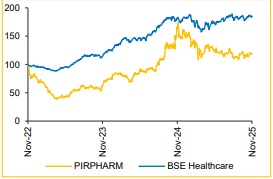

Reduce Piramal Pharma Ltd For Target Rs. 195 By Choice Broking Ltd

Margin and Profitability Under Pressure

Near-Term Margin and Profitability under Pressure

PIRPHARM continues to face pressure on overall financial performance and we apprehend these challenges to persist through FY26. The weakness is led by inventory destocking by a key customer and operational constraints at the Lexington facility. While management remains confident of achieving USD 2 Bn revenue by FY30, medium-term headwinds remain. EBITDA is also set to contract sharply in FY26, with only partial recovery expected in FY27 - still below historical averages.

In line with the revised outlook, we have cut our estimates by 32.8%/7.6% for FY27E/FY28E. We continue to value the company at 35x FY27–28E average EPS, yielding an unchanged TP of INR 195 and REDUCE rating. Our valuation stance is further supported by PIRPHARM’s lower margin and return ratios relative to other CDMO peers.

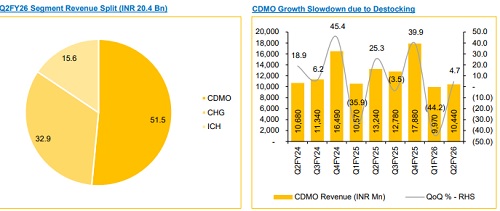

Revenue and Margin Under Pressure; Reports Net Loss

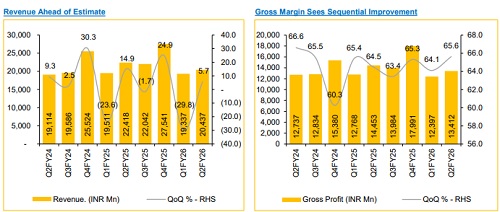

* Revenue de-grew 8.8% YoY but up 5.7% QoQ to INR 20,437 Mn (vs. CIE estimate: INR 21,140 Mn).

* EBITDA de-grew 53.5% YoY but up 48.7% QoQ to INR 1,587 Mn (vs. CIE estimate: INR 1,480 Mn); margin contracted 747 bps YoY but expanded 225 bps QoQ to 7.8% (vs. CIE estimate: 7.0%).

* Reported a loss of INR 992 Mn during the quarter vs profit of INR 226 Mn last year.

Muted FY26 Growth; Recovery hinges on CDMO Normalization

Revenue declined YoY in Q2, driven by continued inventory destocking by a key CDMO customer. FY26 growth is expected to remain muted, with a recovery from FY27 onward, supported by:

* CDMO: Normalisation in customer orders, phase-3 launches over the medium term and the USD-90 Mn ADCelerate investment, which will enhance capacity and capability in Anti-Drug Conjugates (ADCs).

* CHG: Sevoflurane rollout in ex-US markets (45% market share in the US), Baclofen recovery from H2, and a focus on high-margin generics.

* ICH: Sustained momentum in power brands, strong D2C visibility, innovationled pipeline, and improving e-commerce traction.

Sharp Margin Contraction in FY26 Driven by Deleveraging.

EBITDA margin remained under pressure, impacted by operating deleverage and inventory destocking in a high-margin product. We now expect margin (including other income) to decline meaningfully to 13.5% in FY26 (vs 17.3% in FY25), driven by sub-optimal utilization at US facilities such as Lexington, along with continued CDMO weakness from destocking. Margin recovery is expected from FY27 onwards, as facility utilisation improves and destocking normalises.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131