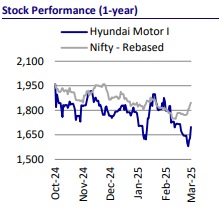

Buy Hyundai Motor Ltd For Target Rs. 1,960 by Motilal Oswal Financial Services Ltd

New model launches planned after the new plant SOP

Well-positioned to benefit from the improving UV mix in PVs

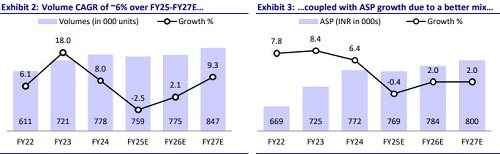

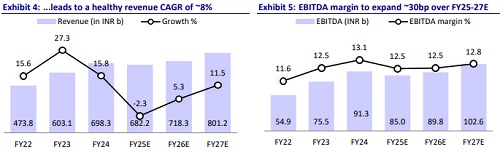

We met with Hyundai's (HMI) management to understand the current industry landscape and the company’s strategic direction. The overall demand environment remains muted, with the PV segment expected to grow modestly at 1-4% in FY26E. SUVs are likely to continue to drive growth, and hence HMI appears to be wellpositioned to benefit from this trend. Its recently launched EV variant of Creta is witnessing a healthy response, and the company expects this to contribute to about 10% of overall Creta sales going forward. Management has indicated that it would continue to explore alternate powertrains, including EVs, hybrids, flex fuels, et al., and would be ready to launch the same in the Indian market with the backing of its parent, as and when the market is ready. For EVs, HMI would like to build a long-term sustainable model that is profitable and hence is gearing up with aggressive localization plans. While exports have remained weak in 3QFY25, management expects the same to stabilize in 4Q and report growth in CY25. HMI is likely to time its new model launches once its Pune plant begins production, SOP for which is scheduled in 4QCY25. Given its SUV-heavy portfolio, HMI is well-positioned to benefit from India's premiumization trend. We reiterate our BUY rating on HMI with a TP of INR1,960, premised on 26x Dec’26E.

Following are the key takeaways from our interaction:

Demand outlook remains bleak; premiumization trend to continue

* The overall demand environment remains weak. During the recent SIAM conclave, industry experts have projected the PV industry to grow at 1-4% in FY26E. UVs are likely to continue to outperform while demand for cars is likely to continue to slide down.

* SUVs continue to be the key growth driver, with even rural markets showing a similar contribution to SUV sales as urban regions. For HMI, rural market contribution has now increased to 21.2% in 3QFY25 from 19.7% YoY. In addition, almost 67.6% of its rural sales are from SUVs.

* The first-time buyer ratio has shown a significant improvement over the years, indicating growing aspirations and purchasing power. For HMI, the first-time buyer mix has increased to 40.1% as of 3QFY25 from 33.6% in 1QFY24. Specifically, models such as the Exter and Venue have witnessed an even higher proportion of first-time buyers, reaching 47%.

* Further, the premiumization trend is clearly visible in the industry. For HMI, sunroof penetration has increased to 53.5% in 3QFY25 from 47% YoY. Similarly, ADAS penetration has increased to 12.9% in 3Q from 3.4% YoY.

* Given the rising aspirations of the Indian consumer, HMI believes that the improvement in the UV mix is here to stay. Given the lack of material traction in the hatchback segment, HMI discontinued the Santro a couple of years back.

* The powertrain mix for HMI is 65% gasoline, 19% diesel, and 15% CNG (up from 11% YoY). CNG mix has improved after the dual-cylinder variant was introduced last year. In Exter, CNG penetration has sharply increased to 36.5% of the mix in 3QFY25 from 17.7% in 3QFY24. Similarly, CNG penetration in Aura is the highest at 90%. The same for i-10 is 20.3%.

Powertrain strategy

* Management has indicated that it would continue to explore alternate powertrains, including EVs, hybrids, flex fuels, etc., and would be ready to launch the same in the Indian market with the backing of its parent as and when the market is ready.

* HMI does not see a challenge in launching hybrids in India if need be, as HMC globally has a strong hybrid portfolio. However, tax rates remain high for hybrids in India, and management does not see the same coming down to make this a viable option in India.

* Within EVs, HMI has recently launched the EV variant of its best-selling model, Creta. Management is currently witnessing a healthy response to the same.

* While management has not provided any order book data, it expects the EV variant to contribute to about 10% of overall Creta volumes going forward. The company does not expect the diesel variant to see material cannibalization due to the EV launch as it has positioned the two differently. Further, management has indicated that EV margins are likely to be lower than ICE in the initial years.

* HMI looks at EVs as a long-term priority and hence, is focused on EVs not just for gaining volumes and share but would like to make this a profitable solution in India. Hence, it is considering aggressive localization of components in India, including battery pack assembly, cells (tie-up with Exide), power electronics, drivetrains, et al.

* After the commencement of the new Pune plant, HMI would look to launch two more EVs in the Indian market.

New model launches to coincide with new capacity additions

* The SOP for the new Pune plant is likely to be scheduled by 4QCY25 for the first phase of 170k units p.a. capacity. The remaining 80k units would be added once the first phase ramps up, taking the total capacity to 1.1mn units p.a.

* HMI is aiming to time its new launches with the new plant ramp-up.

* While the timeline is not known, it targets to launch two more EVs in the Indian market. In addition, HMI would look to tap product gaps below and above the Creta segment.

Exports to stabilize in 4Q; revival likely from next year

* Exports contribute to about 20% of HMI’s volumes. However, recent quarters have presented challenges, particularly due to disruptions in the Red Sea, which impacted shipments to the Middle East. To mitigate this, HMI increased the volume of shipments to Africa in 3Q, albeit this came at the expense of offering higher discounts.

* The Middle East, which contributed 37% of HMI’s exports, declined 10% YoY. In contrast, Africa, which contributed ~28% of the mix, witnessed 15% YoY growth.

* HMI exports Verna to the Middle East and Nios, Aura, and Exter to Africa and Latin America. It has recently started exporting Exter to South Africa.

* Going forward, the company is evaluating export options for Creta EV.

* HMI expects export stability in 4QFY25 and anticipates marginal growth in CY25 following a decline over the past two quarters.

* The company aims to strengthen its position as a manufacturing hub for emerging markets. Management is actively exploring new export destinations and evaluating potential new products for export feasibility.

Focus on localization

* Localization at HMI has improved to 76.8% as of 3QFY25 from 73.5% YoY.

* The company has a dedicated team that works on options to improve localization periodically.

* The company continues to import electronics, including semiconductors, as the supply chain for the same is not developed in India.

* As highlighted in the previous section, HMI has an aggressive localization plan for EV components, including battery pack assembly, cells (tie-up with Exide), power electronics, drivetrains, etc.

Margins likely to improve from 3Q levels

* Margins in 3Q were hit by: 1) an export push to Africa with the help of pricing levers; 2) high discounts in the domestic market; and 3) one-time compensation given to employees post-IPO – a 60bp impact.

* In 3QFY25, HMI received INR1b worth of incentives from the Tamil Nadu government. The same was INR620m in 2Q as it was approved towards the end of the quarter. A similar incentive is expected in 4Q as well.

* Post-3QFY25, raw material costs have remained stable QoQ.

* Margin levers from hereon include: 1) the 1% price hike taken in Jan’25; 2) discounts in exports, which are likely to normalize; and 3) a one-time hit in employee expenses, which would not recur in 4QFY25.

* As a result, we have now factored in the margin to improve to 12.2% for 4Q.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412