Buy Gulf Oil Lubricants India Ltd for the Target Rs. 1,600 by Choice Institutional Equities

Business Overview:

Gulf Oil Lubricants India Ltd (GOLI), part of the Hinduja Group, is a key player in India’s lubricant industry. The company provides high-performance lubrication solutions for both automotive and industrial segments. It serves both B2B and B2C markets, with a strong export presence. The firm’s distribution network of 90,000+ retail outlets, 40+ OEMs partnerships and 500+ B2B clients, ensuring a strong and widespread market presence.

Is GOLI Well Positioned to benefit in lubricants space in Crowded market amid the absence of Government Intervention?

To drive superior returns in the Indian lubricants sector, we believe a company must exhibit (a) strong pricing power, (b) a compelling brand, (c) a clear cost advantage, and (d) strategic exposure to Diesel Exhaust Fluid in anticipation of upcoming regulatory tailwinds.

In our view, Gulf Oil has been able to increase the volume along with the rise in average realised prices as compared to its closest competitor which has been growing volumes below the average industry growth rate. We note that rise in average realised prices could be on the back of either product mix, price hike or schemes. Gulf Oil has been spending less yet making the most of it’s A&P expenses. However, GOLI lags behind the competition in terms of strategic foresight as far as procurement of Base Oil is concerned. Gulf Oil has greater market share in Diesel Exhaust Fluid (DEF) and is expected to grow volumes on the back of BS VII which is expected to be implemented over the next two years.

Why Invest in GOLI?

GOLI is poised for strong growth on the back of several key factors:

* Volume outperformance via Integrated Approach: GOLI’s strategic alignment across operations, sales and strategy has created a competitive advantage. The firm has delivered 7-8% CAGR as compared to industry average growth rate of 3.8%. Moreover, it has the ability to anticipate demand across 15 segments, such as Passenger Cars and Industrials. Therefore, it has invested appropriately in plant’s agility to grow market share in the B2C segment, which accounts for 53% of the business. Having secured partnerships with 40+ OEMS in order to expand in the B2B market, we believe GOLI is well-positioned to increase volumes.

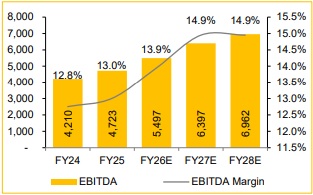

* From Pricing Leverage to Profit Stability – GOLI’s Game Plan: GOLI has raised its average realized price by 21% over the past 7 years, driven by product mix, product hike and schemes. By comparing the average realized price with Brent crude and Asian Base Oils, we conclude GOLI is now focusing on maintaining or increasing margins or increasing margins coupled with volume growth. As we expect Brent prices to decline over the next year, in line with US EIA and IEA; we expect GOLI’s EBITDA margin to rise by 100bps above its current guidance band of 12-14% in FY27E-28E.

* Consistent Investment In Branding Builds Competitive Moat: GOLI has consistently invested INR0.5-1.0 Bn p.a. over the past 10 years in order to build its brand equity. This has propelled loyalty, margin-backed volume growth, and landed GOLI a competitive advantage. The firm has further sharpened its consumer insight by appointing FMCG leaders Abhijit Kulkarni (as COO) and Aarthy Shridhar (as CMO). Additionally, GOLI’s global motorsport associations – most notably with McLaren and Williams Racing – offer a compelling, yet underutilized pathway into passenger vehicle segment where the firm holds <5% market share.

Recommendation:

We currently have a ‘BUY’ rating on the stock with a target price of INR 1,600.

Key Risks:

* Higher than expected depreciation of currency may further pressurise margins.

* Faster than anticipated adoption of Electric vehicles.

* Stricter than expected emission norms, particularly for diesel passenger cars under BSVII.

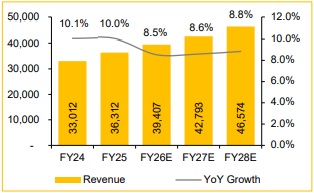

Revenue expected to grow at 8.7% CAGR (FY25-28E)

EBITDA expected to grow at 13.8% CAGR over FY25-28E

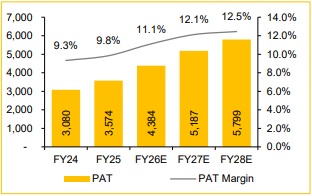

PAT expected to grow at 17.5% CAGR over FY25-28E

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131