Add Havells India Ltd For Target Rs. 1,845 by Centrum Broking Ltd

Lloyd and cables drive healthy growth and margin

Havells India’s (HAVL) sales grew 20% YoY to Rs65.3bn, broadly on expected lines. Key segments driving growth were Lloyd (+40% YoY on favorable base), Cables (+21% YoY), ECD (+9% YoY) while growth was lower in switchgears (+6% YoY) and Lighting (flat YoY). Gross margin fell 70bps YoY/230bps QoQ to 32.1% due to elevated commodity costs. EBITDA grew 20% YoY to Rs7.6bn while EBITDA margin at 11.6% but was above our/consensus estimate of 11%/10.7%. PAT grew 16% YoY to Rs5.2bn (CentE Rs4.9bn). HAVL expects operating leverage to play out and aim to return to 13-14% margin. However, there could be near term growth concerns due to weak secondary sales of cooling products in March-April due to delayed summer (especially in South region) while high inflation may dent demand of real estate product categories. We marginally cut our FY26E-27E EPS by ~3-4%. We downgrade our rating on the stock to ADD (from BUY earlier) with a revised target price of Rs1,845 (Rs1,925 earlier) based on unchanged P/E of 50x FY27E EPS

FMEG – Cables drive growth; ECD, lighting and switchgears remain soft

Sales of FMEG (ex-Lloyd) grew 14% YoY to Rs46.6bn with EBIT margin of 13.9%, down 50bps YoY. Cables and wires grew 21% YoY to Rs21.7bn (equal mix of volume/value growth) with cables outpacing wires growth (65% of sales). Cable demand continue to remain strong while HAVL believe entry of deep pocketed players would lead to industry consolidation in favor of branded players. EBIT margin remained flat YoY at 11.9% while contribution margin fell due to new capacity commissioning, higher commodity costs and product mix. ECD sales grew 9% YoY to Rs10bn while EBIT margin rose 120bps YoY to 12.5% led by better mix of high margin categories. Fans growth was limited in Q4 due to delayed summer. Switchgears sales grew only 6% YoY to Rs6.9bn, due to softness in industrial switchgears. HAVL is a strong player in residential switchgears (~75% of segment sales). Its market share is low in industrial switchgears and is investing heavily in building its portfolio. Lighting sales were flat YoY at Rs4.4bn due to LED price erosion while EBIT margin fell 110bps YoY to 17.1%. HAVL’s strategic investment of Rs6bn in Goldi Solar will ensure uninterrupted supply of solar panels and modules amidst lack of quality suppliers. It will aid strong growth in its Rs4bn solar portfolio.

Lloyd – Primary growth healthy; delayed summer dents initial secondary sales

Sales grew by 40% YoY to Rs18.7bn, led by favorable base (Q4FY24 had grown only 6% YoY) and channel stocking. Despite a strong Q4 primary sales, secondary sales were soft in March & April due to delayed summer (mainly in South). While South could see some growth challenges, North is likely see a heathy uptick. EBIT margin jumped 340bps YoY to 6.2%, led by cost saving measures (achieved the right cost structure) and operating leverage. HAVL will continue to invest in Lloyd brand and R&D. It aims to push more premium products with heightened focus across all 4 categories, gain market share, rope in right brand promoters and improve profitability. Modern retail constitutes 50% of total sales. Other KTAs: (1) OCF in FY25 was Rs15.6bn vs Rs19.6bn in FY24. (2) Ex-cash NWC cycle was flat YoY at 9 days in FY25. (3) Capex of Rs20bn is planned over the next 2 years.

Downgrade to ADD with a revised target price of Rs1,845

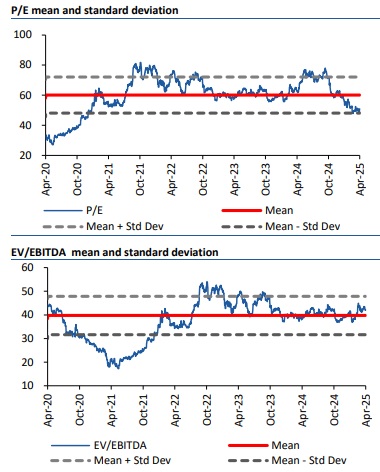

We expect HAVL to post 16% revenue CAGR over FY25-27E and 25% earnings CAGR due to turnaround in Lloyd. We downgrade the rating to ADD as current valuation offers limited upside. Key risk is moderation in demand and weaker-than-expected summer season.

For More Centrum Broking Disclaimer https://www.centrumbroking.com/disclaimer/

SEBI Registration No.:- INZ000205331