Buy Wonderla Holidays Ltd For Target Rs. 799 By Geojit Financial Services Ltd

Growth Ride: New Parks, New Adventures

Wonderla Holidays Ltd. (WHL) is a leading chain of amusement parks in India, operating four major parks in Kochi, Bengaluru, Hyderabad, and Bhubaneswar. The company offers a wide range of land and water rides and provides food and beverages through its restaurants and food courts inside the park.

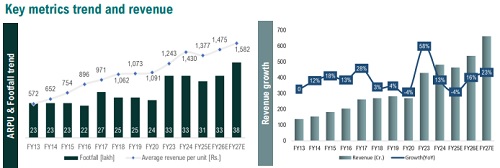

* The new park additions in Bhubaneswar and the upcoming Chennai park are expected to significantly increase overall footfall. We project revenue growth of 16% in FY26 and 23% in FY27, supported by increased footfall and Average Revenue Per User (ARPU) growth.

* ARPU has shown an 11% CAGR from FY13 to FY24, and we expect it to grow in a similar pace to ~Rs.1580 by FY27. We believe the upcoming Chennai park will achieve ARPU levels similar to established centres like Bangalore and Kochi, supporting this growth.

* New park openings typically result in initial margin dilution due to higher setup and operational costs, such as employee expenses. However, as footfall ramps up, margins are expected to increase, making this dilution short-term.

* Active expansion plans, including the upcoming Chennai park, and discussions with the government for expansion North India through an asset-light model, pave the way for a bright future.

* The company's debt-free status enables efficient resource allocation for growth, ensures financial stability, and facilitates effective management of cash flow fluctuations.

Favourable Market Conditions and Strategic Expansion

Wonderla is a leading name in the amusement park industry, is set for expansion, driven by favorable market conditions. Key growth factors include a rising youth population, increasing disposable income, a lack of diverse entertainment options, and government support. Moreover, WHL’s asset-light expansion strategy into new regions enhances scalability and efficiency, allowing the company to leverage market opportunities and build a strong foundation for future growth.

Outlook & Valuation

WHL’s innovative marketing strategies have effectively increased visitor engagement and footfall. The company is projected to achieve a 19% revenue CAGR over the next two years from FY25E, driven by the expansion of new parks and rising demand for entertainment destinations, particularly in Bhubaneswar and the upcoming Chennai park. Although ongoing expansions may temporarily impact margins, a swift recovery is expected due to the strategic location of the Chennai park. We assign a valuation of 18.5x FY27E EV/EBITDA, reflecting the long-term average and initiate coverage with an BUY rating, setting a target price of Rs.799.

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345