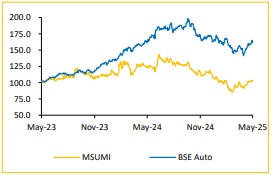

Reduce Motherson Sumi Wiring India Ltd For Target Rs. 56 - Choice Broking Ltd

Despite a strong Q4FY25 performance, near-term EBITDA margins are expected to remain under pressure

* Revenue for Q4FY25 was at INR 25,095Mn, up 12.4% YoY and 9.1% QoQ (vs consensus est. at INR 24,600Mn).

* EBITDA for Q4FY25 was at INR 2,712Mn, down 6.9% YoY and up 14.2% QoQ (vs consensus est. at INR 2,716Mn). EBITDA margin was down 224 bps YoY and up 48 bps QoQ to 10.8% (vs consensus est. at 11.0%).

* PAT for Q4FY25 was at INR 1,649Mn, down 13.8% YoY and up 17.8% QoQ (vs consensus est. at INR 1,646Mn).

Revenue growth to be driven by Greenfield projects: MSUMI is in the process of setting up three greenfield plants for new programs (EV/ICE) for Maruti Suzuki, Mahindra, and Tata Motors. These plants are located in Pune (Maharashtra), Navagam (Gujarat), and Kharkhoda (Haryana). These greenfield plants are in different stages of completion and rampup. The management anticipates annual revenues of approximately INR 21,000Mn to come on stream, once all the plants are in production phase by H2FY26. We believe the EBITDA margin will remain impacted for the coming quarters, with normalization in margin to be seen by H2FY26 as new plants start production and ramp up. Start-up costs will likely peak in 1HCY25 and moderate thereafter, with a positive contribution expected from 4QFY26.

View and Valuation: We revise our FY26/FY27 EPS estimates downward by 6.3%/3.4% to reflect near-term margin pressures arising from greenfield expansion-related costs. Consequently, we lower our target price to INR 56, valuing the company at 30x FY27E EPS (earlier 37x), in line with our expectation of a neutral sector outlook and intensifying competition from MNC players. While MSUMI continues to command a ~40% market share and delivers healthy return ratios, we downgrade our rating from ‘BUY’ to ‘REDUCE’.

That said, we remain constructive on the long-term opportunity as the company is well-positioned to benefit from the industry’s shift toward EV and hybrid powertrains, which is expected to drive an increase in content per vehicle. Ongoing capacity expansion and incremental order wins should support a steady growth trajectory over the medium term.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131