Buy HDFC Life Insurance Company Ltd For Target Rs. 900 By Prabhudas Lilladher Capital Ltd

Pick-up in volume to offset the drag on margin

2QFY26 APE growth was mild at 9% YoY; however, uptick in retail protection post GST rationalization is a key positive. Sustained momentum in ULIP and PAR, pick-up in credit life and recovery in NPAR is likely to result in a better run-rate in H2FY26E at 12% YoY and we build an overall APE growth of 14.5%/ 14.8% for FY26/ FY27E. 2QFY26 VNB margin contracted to 24.1% (H1FY26 VNB Margin at 24.5%) due to the impact of GST exemption. We expect FY26E margin to trend lower at 24%; however strong growth in retail protection volume and improved margin profile in ULIP is likely to offset some of the drag. While we have trimmed our VNB margin estimates for FY26/FY27E, we remain confident of delivery on growth. We value HDFC Life using the Appraisal Value framework and maintain BUY with a TP of Rs 900 (2.6x FY27E P/EV).

* Expect APE growth of 14.5% in FY26E:

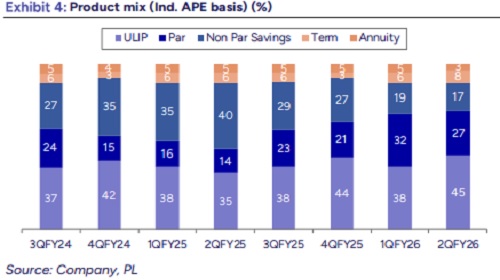

HDFC Life saw a mild growth of 9% YoY in 2QFY26 APE, largely driven by ULIP (+44% YoY) and PAR business (+82% YoY). Term business saw a strong uptick of 49% YoY in 2QFY26 post GST rationalization driven by new launches (Click2Protect Super). Company is seeing green-shoots in the Credit life segment and expects strong growth in H2. NPAR saw a de-growth of 64% YoY on account of pricing aggression and increased competitive intensity. However, it expects to stabilize the business in subsequent quarters as partnerships remain intact. ULIP/PAR/NPAR/Protection/Annuity comprised 42%/29%/18%/7%/4% of Individual APE in 2QFY26. Company has grown 10% YoY in H1FY26 and expects strong momentum in Retail Protection (+27% YoY in H1FY26) to sustain. We build a run-rate of 12% YoY for H2FY26E led by strong growth in retail protection, credit life and recovery in NPAR, resulting in overall APE growth of 14.5% for FY26E. Over the long term, we build an APE CAGR of 15% over FY25-28E.

* Volume growth to compensate for drag on margin:

2QFY26 VNB grew 7.6% YoY to Rs 10.1bn. However, VNB margin contracted to 24.1% for 2QFY26 (vs. 24.3% in 2QFY25) due to the impact of GST exemption and drag of fixed cost absorption. While the commentary indicated a gross impact of ~300 bps on FY26 margin due to the loss of Input Tax Credit on GST, it is engaging with distributors to mitigate the same over the next 2-3 quarters. Strong growth in retail protection volume in H2 and improved margin profile in ULIP is likely to offset some of the drag of GST exemption and fixed cost absorption. We build a VNB margin of 24% for FY26E, considering a moderate impact of GST exemption. Post FY26E, we expect VNB margin to improve to 24.5%/ 24.8% in FY27E/ FY28E as the share of protection and NPAR increases.

* EV growth of 14% YoY; plans to raise capital in H2:

Embedded Value grew by 14% YoY to Rs595.4bn, driven by positive VNB growth, favourable unwind, operating and economic variances. Company saw a ~1% impact on EV due to GST exemption and Operating RoEV on a rolling 12-month basis stood at 15.8%. Persistency trends remained stable -13M/25M/37M/49M/61M persistency at 86%/78%/72%/71%/62% respectively. AUM grew by ~11% YoY to Rs3,600bn. Solvency Ratio reduced to 175% due to (1) dividend payout (2) repayment of Rs 6bn subordinated debt (3) higher share of protection business and (4) impact of GST exemption. Company is planning to raise upto Rs 7.50 bn of sub-debt in one or more tranches in H2, with a migration to riskbased capital approach over the next 12 months, freeing up some capital to fund growth.

* Strengthening banca; focus on agency intact:

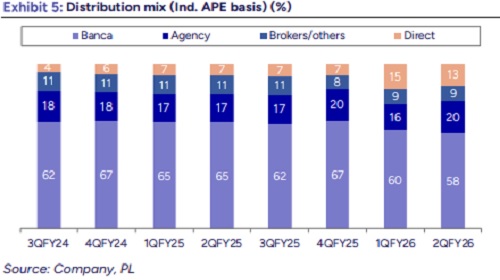

Banca/agency/direct/brokers & others contributed 58%/20%/13%/9% to Individual APE in 2QFY26. Banca APE grew -3% YoY due to slower growth in non-HDFC Bank partners. Company maintained a stable counter-share within HDFC Bank. Agency grew 25% YoY and the company added 51k agents in H1FY26. Expense of Management (EoM) ratio stood at 21.8% for 2QFY26 (vs. 21.3% in 2QFY25) and we expect opex to be elevated over the near-term as the company invests in new capabilities (Project Inspire).

Source: Company, PL

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271

.jpg)