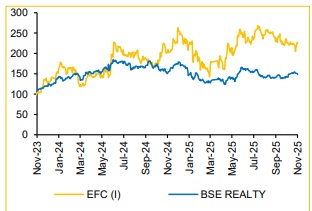

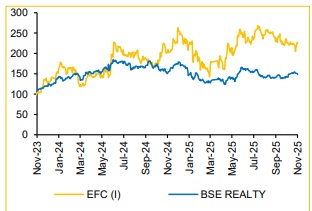

Buy EFC Ltd For Target Rs. 375 By Choice Broking Ltd

Promising Prospects for all 3 Verticals

We maintain our BUY rating on EFCIL, with a revised TP of INR 375/sh. We continue to be constructive on EFCIL owing to :

1) ~22k/20K/15k seat addition in FY26E/27E/28E, cumulatively taking the stock of seats leased under management to 117.5k by FY28E (~doubling from FY25 end).

2) Backward integration into Design & Build as well as Furniture Manufacturing segments, which keeps margin healthy (~30% EBITDA margin).

3) Revenue from Design and Build (D&B) segment to grow at a 50% CAGR over FY25–28E.

4) Revenue from the Furniture Manufacturing segment to grow at a 93% CAGR over FY25 – 28E and EBITDA Margin in the range of 25 – 30%

We forecast EFCIL’s consolidated EBITDA to grow at a CAGR of 46% over FY25 – 28E, supported by our assumptions as discussed above.

Valuation:

We arrive at a 1 – year forward (FY27E – 28E blended) TP of INR 375/share. We now value EFCIL on our EV/EBITDA framework, where we assign an EV/EBITDA multiple of 10x/10x for FY27E/28E (consolidated basis), which we believe is reasonable given its growth potential and margin profile. On our target price of INR 375, FY27E implied P/BV multiple is 3.4x.

Risks:

Possible general slowdown in the domestic economy, wearing out/dwindling startup funding, chances of abating of offshoring/GCC trend and probable predatory pricing by larger competitors.

Q2FY26: Healthy revenue growth and seat addition but margin disappoints

* Revenue for Q2FY26 came in at INR 2,546Mn, up 16% QoQ and 53% YoY vs CIE estimate at 2,533Mn.

* EBITDA (excluding OI) for Q2FY26 was reported at INR 1,108Mn, up 8% QoQ and 40% YoY vs CIE estimate at 1,345Mn. Q2FY26 EBITDA margin came in at 43.5% vs 46.6% in Q1FY26 and 47.7% in Q2FY25 vs CIE estimate at 46.6%.

* EFCIL added 5,032 seats in Q2FY26, taking the total seat count to 68,241 vs 63,389 in Q1FY26. Total billed seats increased to 55,924 vs 53,250 seats in Q1FY26.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131