Neutral R R Kabel Ltd for the Target Rs. 1,430 by Motilal Oswal Financial Services Ltd

Capex-led growth; plant operations integrated and scalable

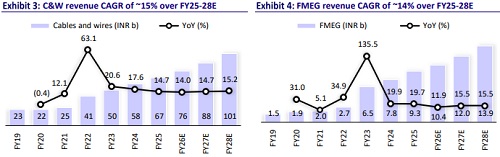

We attended the plant visit event organized by R R Kabel (RRKABEL) at its Waghodia plant in Gujarat, where we interacted with the senior management team, followed by a tour of the plant. Key highlights from the interaction are as follows: 1) the company holds ~6% market share in domestic cables & wires (C&W) and exports to over 74 countries (with Israel recently added to the list); 2) a higher share of in-house manufacturing for key raw materials drives strong backward integration; 3) it has planned capex of INR12.0b spread over the next three years to expand its cable capacity, supporting ~18% CAGR in C&W revenue during this period; and 4) better product mix (increase in cables share) and scale improvement are expected to expand margins.

Key takeaways from the management meeting

* RRKABEL continues to demonstrate strong technical and manufacturing capabilities across its C&W business. The company offers a diverse portfolio of products across various categories: housewires, industrial wires, power cables (low, medium, and high voltage), and special cables.

* In power cables, the company offers a comprehensive range, spanning from 0.08 sq. mm to 1000sq. mm, with an operating temperature range of -65°C to +200°C, and voltage ratings from 12kv to 66kv. The company also plans to expand into 220kv voltage power cables (an EHV cable in the lower range).

* RRKABEL holds 57 system and product certifications. It is the largest exporter of C&W, with a presence in over 74 countries (including the recent addition of Israel). It is the first company in India to launch products compliant with European regulations, such as REACH, ROHS, and CPR. Moreover, it is the first company in India to introduce LS0H insulation technology and UCT products.

* The company’s market share in domestic C&W is ~6%. It has a pan-India presence with a leadership position (among the top three players) across Gujarat, Madhya Pradesh, Rajasthan, and Maharashtra. Additionally, it is expanding in the southern and eastern markets as part of its broader growth targets.

* Internationally, the Europe market remains stable, while US demand remains impacted by tariff-related uncertainties (the US is contributing ~2.5% to the company’s revenue, with margins in the country being higher).

* The company’s manufacturing process is backward integrated, with in-house production of several key materials, including polyvinyl chloride (PVC) compound (95% in-house), LS0H compound, cross-linked polythene (XLPE) compound, and solar cable compound.

* The company has earmarked a capex of INR12.0b to be spent over the next three years, primarily for expanding cable capacity at its Waghodia plant in Gujarat. So far, it has incurred INR1.0-1.5b, with an estimated full-year (FY26) capex of INR4.0b. The new capex is likely to generate revenue of INR40b-45b (with an asset turnover of 3.5x-4.0x) at full-scale operation. Capacity addition will be gradual over the three-year period, with a steady ramp-up in capacity utilization.

* Management is confident that the capex will enable the company to achieve its revenue CAGR target of ~18% over the next three years in the C&W segment, with cables expected to experience higher growth potential compared to wires. The change in product mix (increase in cables share) and scale improvement (as new expansion allows longer-length cables manufacturing, thereby enhancing efficiency and reducing delivery time) are expected to drive margin expansion. The company’s margin in cables is estimated to expand to ~9-10% vs. ~6-7% currently.

* In FMEG, the contribution of fans stands the highest at ~50%, followed by lighting at 31%, appliances at ~10%, and switches/switchgear at ~8-9%. In FMEG, the company’s in-house manufacturing share is ~35%, with third-party purchases accounting for the remaining share. The company manufactures inhouse ceiling fans (including BLDC fans), high-end lighting, and switches.

Valuation and view

* RRKABEL’s volume growth in 1Q was below the industry average due to the spillover of domestic orders and cable capacity operating at optimum levels. The ongoing expansion at the Waghodia plant is estimated to boost cable volumes over the next three years. Management remains confident of achieving its fullyear volume growth guidance of ~18%, supported by a robust 25% growth in cables during 9MFY25. Additionally, the company projects to achieve break-even in the FMEG business in FY26.

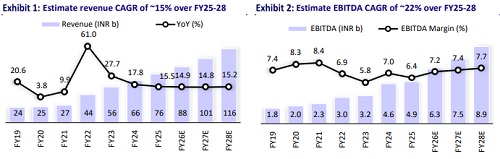

* We estimate RRKABEL’s revenue/EBITDA/PAT CAGR at 15%/22%/19% over FY25- 28. We estimate its C&W segment margin at 7.8%/8.0%/8.2% in FY26/FY27/FY28 vs. 7.4% in FY25. We project the net debt (excluding acceptances) to increase to INR8.6b by FY28 vs. INR1.1b in FY25, led by higher capex. The stock is trading fairly at 36x/32x FY26E/27E EPS. Reiterate Neutral with a TP of INR1,430

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412