Buy Prestige Estates Projects Ltd for the Target Rs. 1,938 by Motilal Oswal Financial Services Ltd

Absence of material launches impacts performance

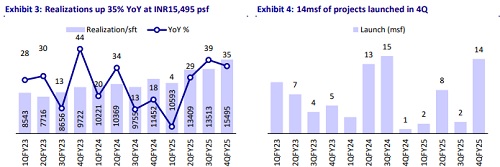

Guidance miss; average realization increases

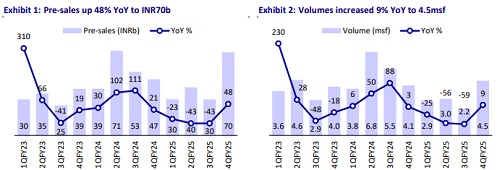

* PEPL reported a 48%/131% YoY/QoQ increase in pre-sales to INR69.6b (31% below our estimates) due to the absence of guided launches in 4QFY25. For FY25, bookings declined 19% YoY to INR170.2b (15% below our estimate and 29% below guidance of INR240b).

* In 4QFY25, significant sales contributions came from Nautilus (34%), followed by Southern Star, Spring Heights, Raintree Park, and Suncrest, which contributed 20%, 16%, 7%, and 5%, respectively. In FY25, these projects contributed 58% of sales, with ~18% of contribution to total sales coming from Nautilus.

* In FY25, 45% of sales came from Bengaluru, followed by 30% from Mumbai, 23% from Hyderabad, and 2% from other markets.

* Post-4QFY25, PEPL holds an ongoing inventory of INR201b across Hyderabad, Bengaluru, and Mumbai.

* The company launched 14.03msf during the quarter, spanning four projects: Prestige Suncrest and Prestige Southern Star-Ph 1 in Bengaluru, Prestige Nautilus in Mumbai, and Prestige Spring Heights in Hyderabad, with a combined GDV potential of INR161.3b. In FY25, the company launched 26.28msf during the year, primarily across Bengaluru, Mumbai, and Hyderabad, with a combined GDV of INR262.2b.

* Project completions stood at 3.04msf in FY25, contributed by two residential projects in Bengaluru: Prestige Primrose Hills Ph-1 and Prestige Waterford.

* Total units sold during the year stood at 5,919.

* Office leasing stood at 4.1msf, with portfolio occupancy at 90%. Malls recorded sales of INR22.6b, with retail occupancy at 99%.

* In FY25, the Board recommended a final dividend of 1.8/share (18% of face value).

* P&L performance: PEPL reported a 29% YoY decline in revenue to INR15.3b (67% below our estimates) for 4QFY25, while for FY25, revenue was down 7% YoY at INR73.5b (29% below estimates).

* EBITDA came in at INR5.4b, down 35% YoY (30% below our estimates). EBITDA margin stood at 35.4%, down 3pp YoY. For FY25, PEPL reported an EBITDA of INR25.6b, up 2% YoY (8% below estimates), with margin standing at 34.8%, up 3pp YoY.

* PEPL reported an adjusted PAT of INR250m, down 82% YoY, with margin standing at 1.6%. For FY25, the company reported an adj. PAT of INR4.7b, down 34% YoY (42% below estimates).

Key highlights from the management commentary

* In 4QFY25, 14msf of new launches were rolled out across Bengaluru, Mumbai, and Hyderabad, with a GDV of INR161.3b; the stock in hand stood at 13.85msf.

* For FY26, the company has guided pre-sales at INR270b, with INR120-130b expected in 1QFY26. The GDV pipeline has moderated to INR420b.

* The company spent INR55b on BD in FY25, including INR14-15b on stake acquisitions that contributed INR200b to GDV, and INR4b on acquisitions in Bengaluru.

* FY26’s BD spend is expected at INR40-45b, likely translating into INR300-400b in GDV.

* INR140b worth of FY25 launches have been spilled over to FY26, with an additional GDV of INR500b currently in the planning stage.

* Approvals are progressing for launches in Evergreen, Raintree Park, Pallavpuram Chennai, and Dahisar-Mira Road.

* Net debt was reduced to INR67b, resulting in a Net Debt/Equity ratio of 0.42, while borrowing costs were reduced to 10.32%.

* BKC will be completed by FY28 and Aerocity office space, which is fully leased out, will be completed by the end of CY25. The planned capex is estimated at INR70-80b.

Valuation and view

* While delays in approvals impacted launches during the year, these have been deferred to FY26.

* As the company advances its growth trajectory in both residential and commercial segments and unlocks value from its hospitality segment, we believe the stock is set for further re-rating. Reiterate BUY with a revised TP of INR1,938 (previously 1,725), indicating a 32% upside potential.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412