Buy Reliance Industries Ltd For Target Rs. 1,515 by Motilal Oswal Financial Services Ltd

Steady 4Q on Retail growth recovery; RJio slightly weaker

* Reliance Industries’ (RIL) 4QFY25 consolidated EBITDA was flat QoQ (+3% YoY) at INR438b (in line), driven by a stronger recovery in Retail (EBITDA +15% YoY).

* RJio revenue and EBITDA grew ~2% QoQ and were slightly weaker than our estimate due to lower-than-expected ARPU and weaker incremental margins.

* Consol. O2C EBITDA grew ~5% QoQ, driven by cost optimization and favorable ethane cracking economics amid weaker refining and petchem spreads. E&P EBITDA declined ~8% QoQ (6% miss) due to lower KG D6 production.

* Attributable PAT rose 2% YoY to INR194b (+5% QoQ) and was 8% ahead of estimate, driven by lower depreciation, interest and tax rate.

* Reported consolidated net debt inched up INR16b sequentially to INR1,171b, while effective net debt (including spectrum debt) was broadly stable YoY at INR2.76t (though lower than INR2.9t in 1HFY25).

* 4Q capex increased ~12% QoQ to INR360b. However, FY25 cash capex moderated to INR1.45t (vs. INR1.57t YoY) due to lower capex in Retail and RJio.

* FY25 gross block additions surged to ~INR1.87t (from ~INR1.5t), likely driven by accelerated investments in New Energy, offset by lower 5G spends.

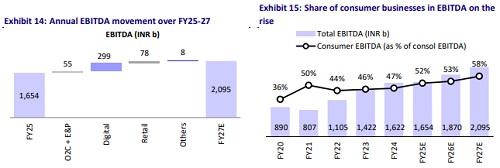

* We lower our FY26-27E EBITDA/PAT by 2% each due to cuts in RJio and E&P. We model a CAGR of ~13-14% EBITDA/PAT over FY25-27, driven by a robust ~21% EBITDA CAGR in RJio and growth recovery in Retail.

* Using the SoTP method, we value the O2C/E&P segments at 7.5x/5x Mar’27E EV/EBITDA to arrive at an enterprise value of INR420/sh for the standalone business. We ascribe an equity valuation of INR525/sh and INR520/sh to RIL’s stake in JPL and RRVL, respectively. We assign INR75/sh (~INR1t equity value) to the New Energy business and INR26/sh to RIL’s stake in Disney JV (based on transaction value). Reiterate BUY with a revised TP of INR1,515 (earlier INR1,510).

Reliance Retail – Strong broad-based growth recovery

* Reliance Retail’s (RR) net revenue jumped ~16% YoY (6% beat), with broadbased growth across categories amid productivity improvement.

* The quarter benefited from regional festivals, wedding season, and early summer, boosting demand across several categories.

* RR continued to consolidate its footprint in 4Q with net addition of 238 stores (1,085 additions and 847 closures). Net retail area was stable QoQ at 77.4m sqft. Overall in FY25, the company added net 504 stores (2,659 additions and 2,155 closures).

* EBITDA grew by a robust 15% YoY to INR67b (4% beat) as margins remained broadly stable at 8.5% (flat YoY).

* RR accelerated quick hyperlocal deliveries on JioMart to 4,000+ pincodes across 2,100+ stores, which led to a 62% YoY increase in average daily orders.

* Reliance Consumer Brands achieved INR115b in revenue in its second year of operations, with Campa gaining double-digit market share in key markets.

* RRVL’s cash capex moderated to INR187b (vs. INR368b YoY), while gross block additions moderated slightly to INR221b (from INR247b YoY).

* FCF (post interest and leases) outflow stood at ~INR8b (vs. ~INR100b YoY).

* Effective net debt increased by INR97b to INR327b.

* We raise our FY26-27 revenue and EBITDA estimates by ~2% and build in a CAGR of 14%-15% in revenue/EBITDA over FY25-27.

RJio – Slightly weaker 4Q; capex and net debt moderates

* RJio’s standalone revenue grew by a modest ~2% QoQ as further benefits of tariff hike and subscriber base normalization were offset by two fewer days in 4Q. ? Overall subscriber net adds came in at ~6.1m (vs. our estimate of ~5m), with 5G user base accelerating to 190m+ and FWA ramping up to ~5.6m homes.

* Blended ARPU inched up ~1% QoQ (and ~14% YoY) to INR206.2/month (lower vs. our estimate of INR208) on residual benefits of tariff hikes.

* EBITDA grew 2% QoQ (+17% YoY) to INR159b (2% miss), largely due to weaker revenue and higher SG&A costs. EBITDA margin remained flat QoQ at 52.8% (~50bp miss). Incremental EBITDA margin for the quarter improved to ~53% (from 45.6% in 3QFY25; lower vs. our estimate of ~70%).

* RJio’s cash capex moderated ~14% YoY to ~INR460b, while gross block additions (proxy for committed capex) declined ~28% YoY to ~INR420b. Management indicated that capex intensity should further moderate in FY26.

* Effective net debt declined significantly by ~INR220b to INR1.87t. RJio generated FCF of ~INR39b in FY25 (vs. FCF outflow of ~INR150b in FY24).

* We cut our FY26E revenue/EBITDA by 3%/5% due to delayed tariff hike benefits and lower incremental EBITDA margins, while FY26E PAT is cut by ~9% on account of lower EBITDA and higher D&A on capitalization of 5G spectrum.

* We continue to build in the next round of tariff hikes (~15% or INR50/month on the base pack) from Dec’25. We expect FY25-28 revenue/EBITDA CAGR of ~17%/21% for RJio, driven by tariff hike flow-through and FWA ramp-up.

Standalone: In-line EBITDA; PAT beat led by higher other income and lower taxes

* Revenue stood at INR1,330b (-9% YoY). EBITDA came in at INR151b (est. INR152b; -25% YoY). ? On a QoQ basis, EBITDA was flat amid similar volumes and steady product cracks. The weakness in EBITDA on a YoY basis was driven by softer cracks in both refining and petrochemicals even as production meant for sale was up 5% YoY at 17.9mmt. Further, the natural decline in KG D6 gas production and lower CBM price realization were partially offset by improved KG D6 gas price realization and higher CBM volumes.

* Standalone results were also impacted by an 11% YoY decline in production from KG D6, 28% lower price realization YoY for CBM gas and maintenance activities. However, a 29% YoY rise was observed in CBM’s production.

* RIL expects stable refining margins amid strong new capacity additions in CY25 (700kbd) and recovery in chemical margins over the next 4-6 quarters from a low base.

* Reported PAT was INR112b (est. of INR96b, flat YoY), a 17% beat vs. our estimate. It was driven by higher-than-expected other income and lower-thanexpected interest expenses and taxes.

* Gas price realization for KG-D6 gas increased to USD10.1/mmbtu in 4QFY25 from USD9.5/mmBtu in 4QFY24. Oil & Gas exploration EBITDA declined 9% YoY/ 8% QoQ to INR51.2b, due to lower KG D6 gas production and lower CBM price and maintenance activities.

* RIL believes that strong seasonal demand is anticipated to support gasoline crack spreads, while supply disruptions are expected to keep middle distillate cracks elevated.

* RIL expects domestic polymer demand to remain strong, driven by growth in ecommerce, agriculture and infrastructure spending. However, the market may face pressure from ongoing global capacity expansions.

Valuation and view

* Segment-wise, we expect RJio to be the biggest growth driver with 21% EBITDA CAGR over FY25-27, driven by one more tariff hike, market share gains in wireless, and ramp-up of the Homes and Enterprise business. We expect growth recovery in retail after the recent rationalization of unprofitable stores and B2B, driven by footprint/category additions and its foray into quick commerce.

* Overall, we build in a CAGR of ~13-14% in consolidated EBITDA and PAT over FY25-27, driven by a double-digit EBITDA CAGR in RJio and Retail. After a subdued FY25, we expect earnings to recover in the O2C segment, driven by improvement in refining margins. However, our FY27E consolidated EBITDA for O2C and E&P is marginally lower than FY24 levels.

* We model an annual consolidated capex of INR1.25-1.3t for RIL, as the moderation in RJio capex is likely to be offset by higher capex in New Energy forays. However, we believe the peak of capex is behind, which should lead to healthy FCF generation and a decline in consol. net debt.

* For Reliance Retail, we ascribe a blended EV/EBITDA multiple of 28x (30x for core retail and 6x for connectivity) to arrive at an EV of ~INR8.8t for RRVL and an attributable value of INR520/share (earlier INR515/share) for RIL’s stake in RRVL. Continued recovery in retail revenue remains the key for RIL’s re-rating.

* We value RJio on DCF implied ~13x FY27E EV/EBITDA to arrive at our enterprise valuation of INR11.4t (USD134b) and assign ~USD10b valuation to other offerings under JPL. Factoring in net debt and the 33.5% minority stake, the attributable value for RIL comes to INR525/share (earlier INR510/share).

* Using the SoTP method, we value the O2C/E&P segments at 7.5x/5.0x Mar’27E EV/EBITDA to arrive at an enterprise value of INR420/sh for the standalone business. We ascribe an equity valuation of INR525/sh and INR520/sh to RIL’s stake in JPL and RRVL, respectively. We assign INR75/sh (~INR1t equity value) to the New Energy business and INR26/sh to RIL’s stake in Disney JV (based on transaction value). We reiterate our BUY rating with a TP of INR1,515.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412