Neutral Tata Chemicals Ltd for the Target Rs. 900 by Motilal Oswal Financial Services Ltd

Unfavorable demand-supply dynamics hurt margins

Operating performance below our estimates

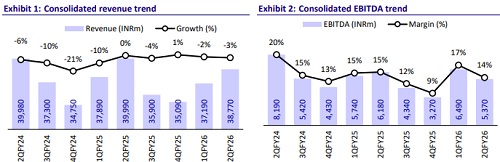

* Tata Chemicals (TTCH)’s 2QFY26 consolidated EBITDA declined 13% YoY, led by subdued performance in America (TCNA)/Africa (TCAHL)/Rallis, with EBITDA down 65%/58%/5% YoY due to a weak demand-supply scenario. India/Europe (TCEHL) delivered a healthy performance with EBITDA up 67%/50% YoY. India operations were better, led by an increase in capacity, operating leverage, and a lower base for the last year. Due to heavy rains in 2QFY25, TTCH had a total cost impact of ~INR400-440m with a production loss of ~30KMT/40KMT of soda ash/salt. However, TCEHL witnessed an improved performance due to a reduction in power and fuel costs (mainly due to the cessation of Lostock in the UK).

* The unfavorable demand-supply scenario of soda ash has led to lower prices globally. India and the US domestic market are witnessing a better demand scenario, while the US exports/Africa/EU are under pressure due to oversupply.

* Factoring in a weak macro environment, we cut our FY26/FY27 EBITDA estimates by 7%/11%. Lower FY26 estimates are on account of a one-off expense of INR1.1b in the UK (~INR650m)/US business (~USD5m) and a weak outlook for the soda ash pricing globally. However, we maintain our FY28 EBITDA estimates, anticipating an improving macro scenario. We reiterate our Neutral rating with an SoTP-based TP of INR900.

Earnings hurt by US and Kenyan operations; India and UK outperform

* TTCH reported total revenue of INR38.8b (est. INR41.9b) in 2QFY26, down 3% YoY, due to a slight decline in soda ash volumes (down 2%). Sodium bicarbonate/salt volumes grew 19%/12%. EBITDA margin contracted 160bp YoY to 13.9% (est. 14.9%), due to lower gross margin and higher employee and freight costs. EBITDA stood at INR5.4b (est. INR6.3b), down 13% YoY.

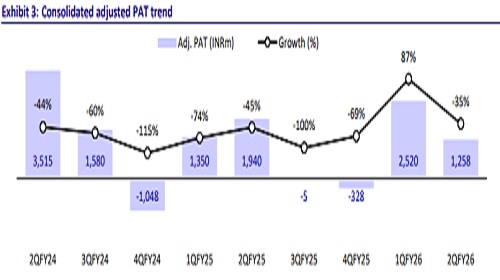

* It posted an adj. net profit of INR1.3b vs. INR1.9b in 2QFY25 (est. ~INR2.1b).

* The Basic Chemistry Products business was down 2% YoY to INR29.8b. EBIT is INR1.2b (down 53% YoY). EBIT margins stood at 4%.

* The Specialty Products business grew 2% YoY to INR9b. EBIT is INR 1.2b (up 2% YoY). EBIT margins stood at 13.7%.

* Indian standalone revenue rose ~19% YoY to INR12b, while TCNA/TCEHL/ TCAHL/Rallis dipped 8%/25%/23%/5% YoY to INR12.3b/INR3.9b/INR1.3b/ INR8.6b.

* EBITDA for India standalone/TCEHL grew 67%/50% to INR2.4b/INR390m, while the same for TCNA/TCAHL/Rallis declined 65%/58%/5% YoY to INR1.9b/INR1.7b/INR1.6b.

* EBITDA/MT of TCNA/TCAHL declined 65%/47% YoY to ~USD14.7/USD36. EBITDA margin for India standalone expanded 560bp YoY to 19.9%.

* For 1HFY26, Revenue/EBITDA declined 2%/1% to INR76b/INR12b, while adj. PAT grew 15% to INR3.8b

* Gross debt was INR67.2b as of Sep’25 vs. INR63.0b in Mar’25. Further, the CFO stood at INR5.4b as of Sep’25, as against INR6.7b in Sep’24.

Highlights from the management commentary

* European business: Margin improvement was led by a better product mix. Going forward, the pharma salt business and in-house manufacturing of CO? are expected to be the key growth drivers. The company expects the business to turn profitable in 3QFY26.

* Capex: TTCH has guided for an annual maintenance capex of INR10b for FY26. The company plans to expand its Indian capacity by 50% in two phases (i.e., 15% + 35%). Further, it plans to add silicate capacity of ~42k tons in Cuddalore and 60k tons in Mithapur. The company is planning to raise INR15b through NCDs for funding these initiatives.

* Africa: Pending litigation concerning land rates has been ruled in the company’s favor. The company will wait to check if the local body takes this matter to the Supreme Court. However, other matters regarding taxes have been completely resolved.

Valuation and view

* Global demand for soda ash is expected to be muted in the near term as the soda ash market is currently oversupplied with high inventory levels, particularly in China (1.65m tons). This is putting pressure on soda ash prices.

* However, the soda ash demand supply scenario is likely to be favorable in the medium term due to better demand from solar glass and electric vehicles. The company is in a good position to capitalize on the demand with capacity expansion in India.

* We expect TTCH to record a revenue/EBITDA/adj. PAT CAGR of 5%/17%/54% over FY25-28. Reiterate Neutral with an SoTP-based TP of INR900.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)