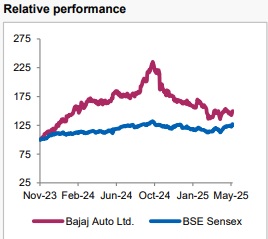

Hold Bajaj Auto Ltd For Target Rs. 9,380 - Axis Securities Ltd

Key Highlights:

On 21st May, 2025, Bajaj Auto Limited’s wholly owned subsidiary, Bajaj Auto International Holdings BV (BAIH), initiated a decisive financial intervention to support the revival of KTM AG, a leading European motorcycle manufacturer facing liquidity distress.

BAIH has:

Extended a secured term loan of €450 Mn (~Rs 4,365 Cr) to KTM AG.

Subscribed to €150 Mn (~Rs 1,455 Cr) worth of convertible bonds issued by Pierer Bajaj AG (PBAG), KTM’s holding company.

This €600 Mn (~Rs 5,820 Cr) infusion is critical to enable KTM to meet its court-mandated restructuring obligations in Austria and avoid insolvency.

[Prior infusion of €200 Mn as convertible bonds/loans to maintain business continuity (FY25 - May’ 25)]

Near-term Impact:

Increased capital deployment in the near term (~Rs 5,820 Cr).

Temporary pressure on consolidated financials, depending on the timing and treatment of funding and interest costs.

Medium-to-Long-term View:

Potential for enhanced revenues, profitability, and valuation uplift upon successful turnaround of KTM.

Strengthens Bajaj’s strategic global footprint, particularly in the high-performance and premium motorcycle segment.

Enhanced brand synergy and IP leverage across India and international markets.

Conclusion:

This transaction represents a pivotal turning point for Bajaj Auto’s global strategy, moving from investor to operator in KTM. While the near-term financial commitment is material, the structural protections, strategic alignment, and brand/market synergies offer meaningful long-term value creation potential.

Valuation & Recommendation

Post Q3FY25 results we had valued the stock at sustainable PE multiple of 23x its Mar'27E core EPS, adding the company’s stake in PMAG and surplus cash reserves at 1x book value to arrive at a TP of Rs 9,380/share. We shall revisit the earnings estimate and Target Price post the Q4FY25 results to be released on 29th May 2025.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633