Reduce PI Industries For Target Rs. 3,650 By Emkay Global Financial Services Ltd

Kumiai revises H1FY25 earnings forecast

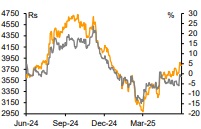

Kumiai Chemical Industry (Kumiai) has revised up its H1FY25 revenue guidance by ~9% to JPY96bn from JPY88bn, citing that net sales are expected to exceed the forecast due to advanced shipment to overseas markets in its Agchem business. Its FY25 guidance is unchanged at JPY159bn. We believe the revision is owing to liquidation of excess AXEEV inventory build-up in FY24 (Kumiai inventory up 50% YoY to JPY75bn). Kumiai maintains ~6 months of inventory, with higher growth expected in its H1 largely factored into PI’s H1FY25 numbers. Also, revising up H1 guidance and keeping full-year guidance unchanged implies lowering of H2 guidance. PI, in its Q4FY25 call, has already given guidance for a mid-single digit growth in FY26; there is no major upgrade in Kumiai’s numbers for FY26. We maintain REDUCE on PI with unchanged TP of Rs3,650, and await visibility on scale-up of new patented molecules.

Kumiai revises H1FY25 earnings forecast; full year remains unchanged

Kumiai revises up its H1FY25 revenue/operating income/APAT guidance by ~9%/34%/7%, respectively, keeping its FY25 earnings forecast unchanged. The revision is due to advanced shipment to overseas markets for its agrochemical business. This has led to increase in operating income led by operating leverage. Ordinary income (PAT) is largely unchanged, due to large forex losses caused by appreciation in the Yen. The company may revise its full-year forecast on visibility of future performance trends, and will make a prompt disclosure. The revised H1FY25 revenue is likely to see ~9% YoY growth; operating income will grow ~6% YoY. Operating income margin for Q2FY25 is expected to fall by 200bps YoY, given pricing pressure called out in Dec-24.

We believe the H1 revision is because of destocking of the AXEEV inventory

Kumiai’s finished goods inventory grew, from 116 days as of FY23 (Oct-23) to 170 days in FY24 (Oct-24). Interestingly, the number of inventory days for PI dropped from 62 in FY24 to 45 in FY25. We understand that Kumiai had front loaded AXEEV inventory in the last 1-1.5 years, on higher demand expectations. Also, it faced pressure from entry of generics in key markets like Australia, China, and Brazil which led to inventory pile-up. Kumiai’s inventory has reduced to ~JPY71bn in Jan-25 from ~JPY75bn as of Oct-24. Guidance revision indicates further destocking led by higher sales volumes (accounting for price decline and forex loss), and has no significant impact on PI’s FY26 sales target.

PI’s guidance of mid-single digit already reflects in the muted outlook for FY26

PI’s mid-single digit revenue growth guidance for FY26 (largely back-ended) is justified by Kumiai’s inventory destocking. The company remains cautiously optimistic on CSM exports. We believe the lower growth guidance is factoring in the YoY price erosion in case of pyroxasulfone which would be offset by volume growth. We build in revenue growth of 8% YoY for FY26E, with a mid-single digit growth in the CSM exports business, low double-digit growth in the domestic agchem business, and 75% growth in pharma.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354