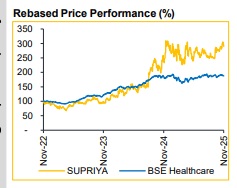

Buy Supriya Lifescience Ltd For Target Rs. 1,030 By Choice Broking Ltd

Margin Moat Built on Integration and Therapy Leadership

SUPRIYA has built a durable and defensible margin moat, consistently delivering 30–35% EBITDA, well above Indian API peers (mid-20s). This structural edge is driven by two entrenched strengths:

* Deep backward integration: ~18 integrated products contribute 81% of Q1FY26 revenue, buffering the business from input volatility and ensuring stable realizations.

* Dominance in niche therapies: Leadership in anesthetics and anti-anxiety APIs—markets with limited domestic competition support premium pricing power.

Margins are expected to temporarily soften to ~33% in FY26E due to Ambernath scale-up costs. However, we believe EBITDA margin is positioned to normalise at ~35% by FY28E, sustaining structural leadership.

Demand Visibility in Place Before Capacity Fills

SUPRIYA’s historic capacity utilisation levels of 85–86% are well above industry average. This is not a capacity-led growth story; it is a demand-pull expansion. The commissioning of the Ambernath formulation facility is expected to temporarily ease utilisation to ~75%, but this is strategic slack created ahead of visible demand. We believe utilisation will rebound to ~80-85% by FY27-end, restoring tight capacity once again.

Importantly, SUPRIYA is planning the next leg of expansion before hitting a constraint with the construction of the Patalganga site (3x Lote Capacity), which begins in FY27-end, exactly when the current sites approach peak utilisation.

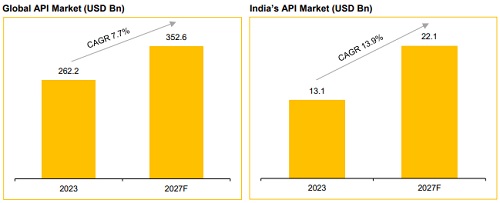

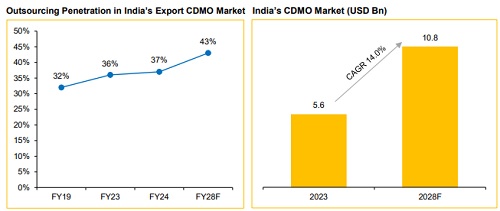

CDMO Capabilities and Global Footprint Power Next-phase Growth

A 10-year contract with a European pharma major marks a transition, from a pure API player to a CDMO-backed growth model. The Ambernath facility provides dedicated capacity for these CDMO supplies, converting opportunity into executionreadiness. Additionally, early development of GLP-1 intermediates adds a mediumterm growth option in one of the world’s fastest growing therapeutic classes. By FY30E, Europe is set to become SUPRIYA’s largest market (~41.5% revenue), while US exposure remains <3%, insulating margin from any tariff risk.

Investment View: We believe SUPRIYA is positioned for sustained, highquality growth, backed by deep backward integration, niche therapy leadership with a strategic shift towards high-margin CDMO and GLP-1 intermediates, which reinforces long-term earnings visibility.

We forecast Revenue/EBITDA/PAT CAGR of 21.6%/18.9%/19.4% over FY25–28E, driven by operating leverage and a richer mix of complex, higher-value products. With contracted revenue visibility, we value the business using DCF method (click here to view). With a TP of INR 1,030 and a 38.6% upside, we initiate our coverage with a BUY rating on the stock. This results in an implied PE of 29x, broadly in line with peers with a PEG ratio of 1.5x.

Risks to our BUY rating: Slower CDMO onboarding.

Our Investment Formula for SUPRIYA

* Margin Moat + Therapy Focus → Premium Returns That Sustain Cycles

* High Utilisation + Pre-Emptive Capex → No Overbuild, Fast Cash Conversion

* European CDMO Contract + <3% US Exposure → Predictable Earnings, Tariff Insulated

* GLP-1 Optionality + China+1 Positioning → Growth Without Capex Drag

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131