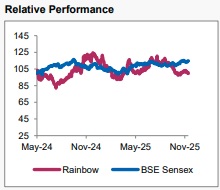

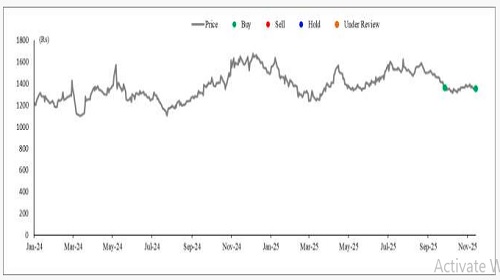

Buy Rainbow Children`s Medicare Ltd For Target Rs. 1,625 - Axis Securities Ltd

Steady Performance, Lower Seasonality; Maintain BUY!

Est. Vs. Actual for Q2FY26: Revenue – INLINE; EBITDA Margin – BEAT; PAT – MISS

Changes in Estimates Post Q2FY26

FY26E/FY27E: Revenue: -1.9%/-1.9%; EBITDA: -2.2%/-2.5%; PAT: -3.4%/-3.4%

Recommendation Rationale:

* In Line Revenue Performance: Rainbow delivered revenue broadly in line with expectations, growing 7% YoY and recovering 26% sequentially. The quarter was largely impacted by a lower incidence of vector-borne diseases, in line with broader industry sentiment. Revenue growth remained subdued as admissions related to seasonal infections were lower. IP discharges declined 1% YoY, while OP consultations and deliveries increased 6% and 7%, respectively.

* Strong Sequential Margin Recovery: The company reported an EBITDA margin of 33.5%, an expansion of 411 bps QoQ but a decline of 176 bps YoY. EBITDA stood at Rs 149 Cr, up 44% QoQ but flat YoY, reflecting strong operational leverage. It reported PAT of Rs 76 Cr, flat YoY.

* ARPOB Driving Growth: The Average Revenue Per Occupied Bed (ARPOB) stood at Rs 57,396, up 15% YoY but declined 9% QoQ in Q2FY26, reflecting continued improvement in case mix, pricing, and operational efficiency across the sector. Overall hospital occupancy was 52%, down from 60% in Q2FY25 but up from 40% in Q1FY26.

Sector Outlook: Positive

Company Outlook & Guidance

Rainbow is well-positioned for sustained growth, with management guiding for a 20% consolidated revenue CAGR over the next 2–3 years, supported by the addition of 780 beds in the last two years and a strong pipeline of new units over the next 3–4 years. The newly appointed Group CEO is expected to strengthen execution and operational discipline. The business mix continues to improve, with tertiary and quaternary care contributing ~40% of H1FY26 revenue, and the IVF segment projected to grow 50% YoY in FY26 and maintain a 25% CAGR thereafter. New units such as Rajahmundry, Electronic City, and Hennur are expected to break even within 12–18 months, supporting profitable expansion. Management expects 8–10% organic growth from mature units, while margins in Tier-2/3 markets remain comparable to Tier-1 despite 25–30% lower pricing, reflecting strong brand equity. With Rs 100 Cr capex planned in H2FY26 and Rs 600 Cr over the next three years, Rainbow remains well placed to expand its footprint, uplift case mix, and sustain margin strength over the medium term.

Current Valuation: 23x EV/EBITDA H1FY28E

Current TP: Rs 1,625/share (Earlier TP: Rs 1,625/share)

Recommendation: We maintain our BUY recommendation on the stock.

Financial Performance

Rainbow delivered a steady financial performance in Q2FY26, with revenue rising 6.5% YoY to Rs 445 Cr, supported by a strong 15.3% YoY increase in ARPOB, though partially offset by a 9% decline in OBDs due to lower seasonal admissions. Performance across units was mixed; mature facilities posted a 3% YoY decline in revenue and a 19% drop in OBDs, while ARPOB rose 17% YoY with occupancy at 56%. Conversely, new facilities continued to scale up well, recording 35% YoY revenue growth, with OBD and ARPOB increasing 20% and 16% YoY, respectively, supported by a 22% YoY increase in bed capacity.

EBITDA remained broadly flat YoY at Rs 149 Cr, with margins contracting by 176 bps YoY to 33% due to muted revenue traction amid late-seasonality impact. Sequential performance improved meaningfully, with EBITDA rising 44% QoQ and margins expanding 411 bps QoQ, reflecting strong operating leverage. PAT stood at Rs 76 Cr, 40% QoQ.

During the quarter, Rainbow integrated the recent acquisitions (Warrangal- Prashanthi and GuwhatiPratiksha) and commercialised the new hospital at Rajahmundry. The company incurred Rs 260 Cr in capex in Q2FY26 (including acquisitions) and closed the period with a healthy net cash balance of Rs 560 Cr.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633