Market Explorer - August 2025 by Religare Broking Ltd

MARKET OVERVIEW

In July 2025, the stock market witnessed a moderate decline, with the Nifty 50 slipping around 2.9% and the Sensex recording similar losses, ending a four-month rally. The weakness was driven by persistent FII outflows of over ?45,000 crore, global trade tensions, and concerns over proposed U.S. tariffs on Indian exports. Market sentiment was further dampened by subdued Q1 earnings and geopolitical uncertainties. However, improving domestic indicators, moderating inflation, and expectations of further policy support from the RBI helped cushion the overall sentiment, providing some support amid global volatility and keeping investor interest intact in select sectors.

MARKET OUTLOOK

Looking ahead, the market is expected to maintain a cautiously optimistic tone, supported by improving domestic macro fundamentals and early signs of rural demand revival amid a favourable monsoon. The ongoing Q1FY26 earnings season will remain a key driver of stockspecific action. However, global headwinds such as the trajectory of US bond yields, weak FII sentiments, and geopolitical tensions may lead to intermittent volatility. Investors will also closely watch the RBI’s monetary policy outcome and developments on global trade negotiations.

Investors should adopt a selective buy-on-dips strategy, focusing on fundamentally strong stocks with solid balance sheets and long-term growth potential. It is advisable to avoid chasing stocks with stretched valuations or those that are more vulnerable to global market volatility

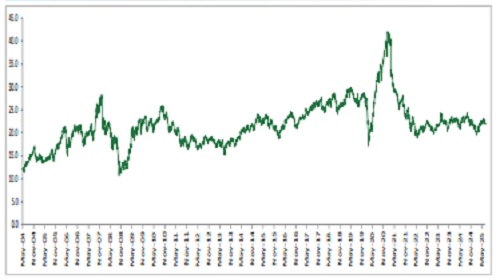

Nifty PE Movement

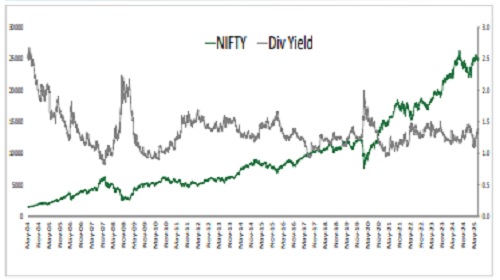

Nifty Dividend Yield Chart

MONTHLY OUTLOOK

The Month That Was:-

Nifty lost 748.70 points in the month of July, 2025

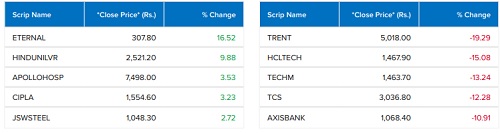

Below is a summary of Top Nifty Gainers & Losers:

Top Nifty Gainers July 2025 Top Nifty Losers July 2025

* Breadth of Nifty stocks was negative - 15 stocks closed in green, 35 stocks ended lower in the month of July, 2025.

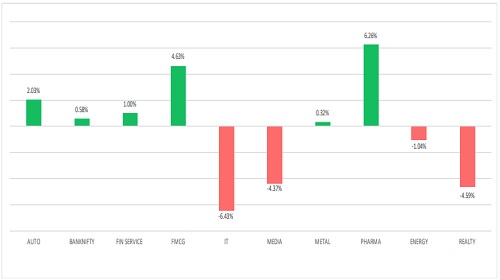

* Relative comparison shows Pharma, FMCG, Auto were the outperformers whereas, IT, Realty, Media, Energy under performed in July, 2025.

Sector Relative Performance

Outlook for Nifty 50 (24,768.35)*

Support 24,450/24,180/23,900

Resistance 25,000/25,300/ 25,600

* After four consecutive months of gains, the Nifty ended July on a weak note, slipping nearly 3%. Bearish sentiment dominated the month, with selling pressure surfacing on every rebound. Resistance levels continued to shift lower, while key support zones were breached. Consequently, the index erased the gains from the previous month and settled at 24,768.35.

* Amid the correction in the benchmark index, sectoral performance was mixed. Pharma, FMCG, and auto sectors emerged as top gainers, while IT, realty, media, and energy sectors closed in the red.

* The underlying tone of the Nifty has turned bearish in the short term, suggesting a potential for further downside. The index is nearing the lower band of its previous consolidation range around 24,450, which is expected to act as immediate support. A breakdown below this level could accelerate the decline toward 24,180-a zone aligned with the long-term 200-day Exponential Moving Average (DEMA). On the upside, the 20- day EMA near 24,950 is likely to cap any short-term recovery. A decisive close above this level could open the door for a move toward 25,250, where a potential bullish reversal might emerge. Given the prevailing scenario, it is prudent to restrict aggressive positions and prefer hedged approach, with focus on stock-specific approach.

Outlook for Bank Nifty (55,961.95)*

Support 54,900/ 54,000/53,300

Resistance 56,500 / 57,400/ 58,200

* The banking index initially attempted to sustain its gains, consolidating within a defined range and briefly outperforming the benchmark index. However, it eventually lost momentum and drifted lower, mirroring the broader market weakness and the mixed performance of its heavyweight constituents. By the end of the month, the index settled at 55,961.95, marking a decline of 2.36%.

* Within the index, strength was visible in major constituents such as ICICI Bank and HDFC Bank. However, their gains were outweighed by sharp declines in other key private players like Kotak Mahindra Bank and Axis Bank, both of which fell over 8-10% on a month-on-month basis. Additional pressure came from IndusInd Bank, AU Small Finance Bank, and Canara Bank, all of which posted significant losses, dragging the index lower.

* After a phase of strong outperformance, the banking index is now exhibiting signs of selling pressure, with further downside potential remaining. There is a possibility of the index testing the 54,900-54,400 zone, with 54,400 acting as a crucial role-reversal level- a prior breakout zone that has historically served as strong support. Given the current setup, a cautious approach is warranted. Fresh long positions should be avoided until a clear revival in bullish sentiment is evident. A sustained move above the 56,500 mark -which coincides with the 20-day EMA -would be the first sign of recovery, with 57,400 serving as the next key resistance level.

Please refer disclaimer at https://www.religareonline.com/disclaimer

SEBI Registration number is INZ000174330

More News

Nifty failed to build on Monday`s gains and ended nearly half a percent lower amid volatilit...