Buy Godrej Properties Ltd For Target Rs. 2,520 By Choice Broking Ltd

Strong Launch Pipeline Ahead

Pre-sales on Track to Outperform Guidance

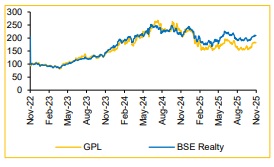

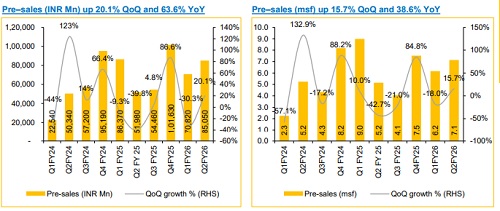

We maintain our BUY rating on Godrej Properties Ltd (GPL) with a TP of INR 2,520. GPL delivered robust pre-sales growth of 63.6% YoY and 20.1% QoQ, achieving 48% of its FY26 pre–sales target within H1FY26, with an even stronger performance expected in the second half.

Strong launch pipeline ahead: GPL targets FY26 pre-sales of INR 325Bn (+10% YoY) on the back of healthy launch pipeline spread across Gurgaon, Greater Noida, and Worli in H2FY26E, with major launches like Godrej Golf Links, additional projects like Indore, Rajendra Nagar, Upper Kharadi Ahmedabad, and Raipur. Even if some of these expected launches slip into FY27, there is scope for GPL’s FY26 pre-sales beating guidance of INR 325Bn.

Maturing prices can easily be offset by strong growth: GPL generally sells ~80+% of the inventory in a launched project while the rest is retained to capture any price appreciation. Price increases in most of GPL’s launched projects across regions has been in the low singe digits, which is quite modest, but it is understandable given the cycle maturity. GPL’s launch pipeline and opportunistic business development can easily offset slowdown in price increase, in our view.

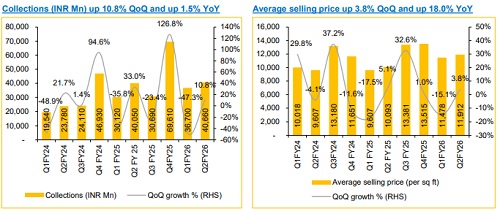

GPL on track to outperform its FY26 guidance on all fronts: During H1, GPL has achieved a) 48% of its pre-sales guidance of INR 325Bn, b) 37% of its customer collection guidance of INR 210Bn, and c) 3.0 msf delivery, which is 30% of its guidance of 10 msf. In addition, GPL is on track to outperform its business development target of INR 265Bn, achieving 81% in H1FY26 itself.

Fund raise to support business development: GPL successfully raised INR 60Bn crore through a QIP which will significantly support its business development while ensuring a strong balance sheet. Going forward, GPL intends to fund most of its business development through internal accruals.

Valuation:. Based on the SOTP valuation approach, we arrive at a target price of INR 2,520 factoring in ongoing and upcoming owned/JV projects, DM & commercial project pipeline and land bank.

Risks: A potential broad based slowdown in the domestic economy and delay in legal issues and regulatory bottlenecks.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131