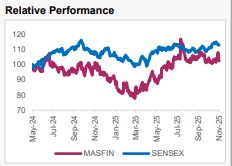

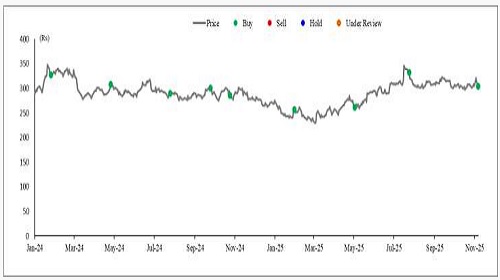

Buy MAS Financial Services Ltd For the Target Rs.380 by Axis Securities Ltd

Green Shoots Visible on Growth and Asset Quality!

Est. Vs. Actual for Q2FY26: NII – MISS; PPOP – MISS; PAT – BEAT

Changes in Estimates post Q2FY26

FY26E/27E/FY28E (%): NII: -2.3/-0.1/+1.6; PPOP: -0.4/+1.7/+2.3; PAT: -1.6/+2.0/+2.6

Recommendation Rationale

* Prudent Growth While Prioritizing Asset Quality: MAS has consciously pruned its growth amidst an uncertain and challenging credit environment, especially in the customer segment the company caters to. However, the management believes the worst is behind and expects AUM growth to pick up meaningfully over H2. MAS has guided for AUM to improve to 5-7% QoQ in Q3 vs 4% in Q2, and a gradual improvement in Q4, as it believes that the on-ground demand from eligible borrowers continues to improve over Sep-Oct’25. Mas has seen rejection ratios declining across products. Within the SME segment, a key growth driver for the company, the management expects the growth in the MEL segment to lag overall growth. Focus will remain on the higher ticket size SME segment. Over the medium term, the share of the SME segment is expected to settle at 65-70% vs 75% currently. MAS remains committed to growing its AUM at a consistent pace of 20-25% CAGR over the foreseeable future, and our estimates align with the management’s guidance as we pencil-in ~23% CAGR growth over FY26-28E.

* Asset Quality Steady; Gradual Improvement Hereon: MAS’s asset quality outcome has been largely range-bound despite the unfavourable macros, especially in the segment the company operates in, and believes that the worst in terms of asset quality is behind. The company intends to maintain GNPA/NNPA in a tight range of 2.5-2.75%/1.5-2% on a steady state basis. The company does not expect the impact of the US tariff on its SME segment customers. MAS has been cautious in its lending approach in the textile and FMCG segments and restricted incremental funding to these sectors. Additionally, it is not seeing any concerning signs of further stress build-up in these segments and will re-look at liberalising credit flow to these segments post Dec’25. The company has seen rejection rates decline across segments.

* RoA to be maintained between 2.85-3% on a normalised basis: MAS has been looking to expand its branch network as it looks to scale up its direct distribution network and expects the retail distribution to contribute to ~75% of the sourcing over the next 2-3 years. Moreover, the management expects to leverage the existing distribution network and work towards improving efficiency to keep Opex ratios range-bound. The management has guided for the C-A Ratio/CI Ratio to settle between 2-3%/35-38% over the medium term. Furthermore, the management expects to realise the benefit of borrowing repricing over the next couple of quarters, driving margins higher. Thus, with greater agility to accelerate growth at better yields offsetting higher Opex and marginally higher credit costs, the management is confident of maintaining RoA of 2.8-3% on a normalized basis.

Sector Outlook: Positive

Company Outlook: As the macro environment turns favourable and rejection rates decline, MAS will look to accelerate growth over H2. The ramp-up of the direct distribution channel will be a key growth enabler, facilitating strong growth at better yields, which would offset the impact of higher Opex. A meaningful repricing of borrowings should drive NIMs higher. Asset quality has held up well despite unfavourable macros, especially in the customer segment the company caters to, and is expected to improve over H2. Thus, we expect MAS to deliver a healthy 23/24/25% CAGR AUM/NII/Earnings growth over FY26-28E, while maintaining RoA/RoE of 2.8-2.9%/14-16% over the medium term.

Current Valuation: 2.1x FY27E BV Earlier Valuation: 2.2x FY27E BV

Current TP: Rs 380/share. Earlier TP: Rs 400/share

Recommendation: We maintain our BUY recommendation on the stock.

Financial Performance:

* Operational Performance: MAS’s disbursements growth was slow at 6/2% YoY/QoQ. The share of sourcing from NBFC partners stood at 34.4% vs 35.2% QoQ. AUM growth stood at 18/4% YoY/QoQ. The MSME segment (~76% Mix) grew by 13/3% YoY with MEL growing at 10/4% YoY/QoQ and SME growth slightly slower at 17/2% YoY/QoQ. In the wheels portfolio, CVs grew by 18/10% YoY/QoQ, and 2-Wheelers grew by 30/6% YoY/QoQ. The salaried personal loans segment growth slowed down and grew by 71/4% YoY/QoQ and constitutes 9% of the portfolio.

* Financial Performance: NII grew by 24/1% YoY/QoQ, aided by steady AUM growth, though NIMs (calc.) contracted QoQ by ~18 bps. NIMs (calc.) stood at 7.2% vs 7.4% QoQ. Non-interest income growth was strong at 40/10% YoY/QoQ. Opex continued to reflect investment trends as the company shifted towards a direct distribution model and grew by 42/8% YoY. C-I Ratio stood at 36.3% vs 34.8% QoQ. PPOP grew by 23/2% YoY/QoQ. Credit costs came in lower than expected and stood at 163bps vs 193bps QoQ. Earnings grew by 17/7% YoY/QoQ.

* Asset Quality deteriorated slightly with GNPA/NNPA at 2.53/1.69% vs 2.49/1.63% QoQ.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633