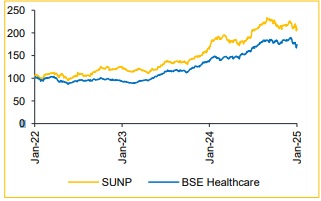

Buy Sun Pharmaceuticals Ltd For the Target Rs. 2,200 by Choice Broking Ltd

Revenue, EBITDA, and PAT Beat Estimates Driven by Growth Across All Regions

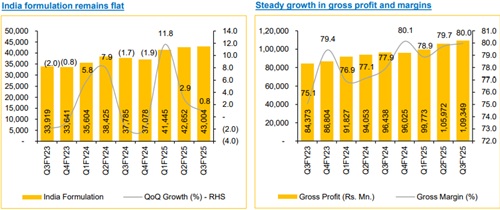

* Revenue increased by 10.5% YoY and 2.9% QoQ to INR 136.8 Bn (vs. consensus estimates of INR 133.8 Bn).

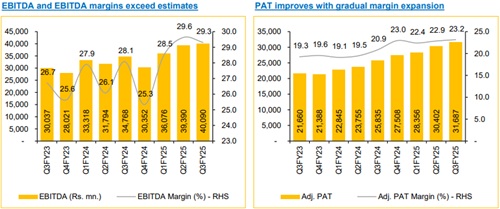

* EBITDA grew by 15.3% YoY and 1.8% QoQ to INR 40.1 Bn, with the EBITDA margin expanding 123bps YoY but contracting 32bps QoQ to 29.3% (vs. consensus estimates of 27.5%).

* Adj. PAT rose by 22.7% YoY and 4.3% QoQ to INR 31.7 Bn (vs. consensus estimates of INR 28.5 Bn), with a PAT margin of 23.2%.

Sun pharma expands market share to 8.2%; expected to outperform IPM growth in FY25

Sun Pharma, India’s largest pharmaceutical company, holds an 8.2% market share, up from 7.8% last year. The company continues to outperform IPM through volume-led growth and new product launches. We expect this outperformance to continue, with IPM projected to grow 8-9% in FY25, driven by strong performance across key therapeutic areas such as cardiology, dermatology, and ophthalmology

Sun Pharma’s Specialty Business to Continue Growing, Driven by Expansion and Acquisitions

Sun Pharma's specialty revenue grew 24.8% YoY, reaching USD 370 Bn, driven by strong performance across both US and ex-US markets. Specialty R&D now accounts for ~41% of total R&D expenses. Ex-US markets have seen increased adoption of Ilumya and Cequa, particularly in Europe and Emerging Markets. A sequential decline in Q4 is expected due to higher inventory stocking by partners in Q3. We expect recent acquisitions and partnerships to further support growth, with Ilumya continuing to gain significant market share and Winlevi potentially securing ex-US approvals.

View and Valuation:

We have slightly increased our FY26/27 EPS estimates by 1.1%/1.0% and maintained our 'BUY' rating with a target price of INR 2,200, applying a 32x multiple (unchanged). The company is expected to continue outperforming the IPM in its India business through new product launches and sustain its growth momentum with recent acquisitions. This should help offset challenges in RoW markets, which are expected to normalize in FY26.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131