Buy Apex Frozen Foods Ltd For Target Rs. 284 By Geojit Financial Services Ltd

Volume Recovers, Europe Adds to Future Growth

Apex Frozen Foods Ltd. (Apex) is a South India (Andhra Pradesh) based exporter of processed shrimps with a capacity of 34,240MT.

* In Q1FY26, revenue increased 39% YoY to Rs.258cr, supported by 17% growth in volumes and a 19% improvement in realisations, partly aided by INR depreciation.

* Gross margin rose 140 bps YoY to 32.9% YoY, while EBITDA margin widened 30 bps YoY to 6.0%. However, profitability remains below pre-Covid levels of ~10– 11%, primarily due to softer realizations and elevated farm-gate costs.

* Recently, the US imposed a 50% tariff along with a 5.77% countervailing duty on Indian exports. This development poses a major headwind for India’s export sector, while trade negotiations between the two countries are still underway.

* Apex has been actively diversifying its market presence, helping mitigate risks from a high US dependency amid tariff challenges. The contribution of non-US markets to total sales has risen to ~45%, up from ~24% over the past seven years.

Outlook & Valuation

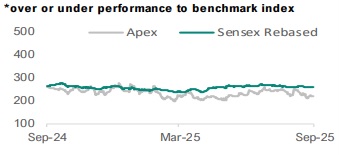

Apex entered FY26 with strong operational momentum, supported by volume and margin recovery along with strategic diversification. However, the U.S. tariff escalation—now totaling 50%—poses a near-term risk to demand and pricing. Apex’s proactive shift toward EU, Canada, and UK markets, coupled with stable global shrimp prices and declining freight costs, positions it well to navigate volatility. Apex targets ~10% share from the UK market (5% in FY25) post-FTA. Additionally, the recent approval from the EU for the RTE (ready-to-eat) product facilities unlocks new opportunities, expected to drive incremental growth in the coming quarters, and expects ~30% growth in EU sales in the first year post-approval, translating to ~2,500 MT additional volume as per the company. Expect revenue/EBITDA to grow at 13%/85%, respectively, over FY25-27E. We value Apex at 17X P/E and recommend BUY rating with a revised target price of Rs. 284.

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345