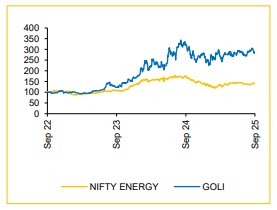

Buy Gulf Oil Lubricants India Ltd for the Target Rs.1,600 by Choice Broking Ltd

Key Takeaways from Management Meet:

We met the CEO (Mr. Ravi Chawla) at GOLI’s head office in Mumbai. We asked some of the key investor questions regarding (1) Overhang of EV penetration (2) Scope of Industrial Lubricants (3) Plant Expansion (4) OEM partnerships and (5) Fluids for Data Centres. Our discussion also revolved around: (i) Pricing strength (ii) Branding and (iii) Cost of suppliers. Please refer to initiation report which showcases deep-dive analysis of the lubricants market including the above parameters.

1) Overhang of EV penetration:

(a) GOLI through its subsidiary Tirex, has already started supplying AC home chargers to MG Motors, for which EVs account for majority of its sales in India. In addition to MG Motors, the company is also supplying AC as well as DC chargers to other customers and has received 12+ OEM approvals for the same. GOLI has acquired 51% stake in Tirex, a DC fast charger and AC charger manufacturer as part of its strategic push amidst the potential penetration of EVs. This reinforces our confidence in GOLI’s agility to distinctively identify the pockets of growth, have a suitable product ahead of the market requirement and deliver it through aggressive sales. Please refer to our investment thesis on the next page as well as our initiation report, wherein we have dived deeper into the lubricants market. (b) In our opinion, for the fuel and lubricants’ consumption to reduce significantly, the EV manufacturers may need to penetrate the commercial vehicle segment. Meanwhile, the PM E-DRIVE initiative offers incentives of up to INR 9.6 lakh per electric truck in N2 and N3 categories. This aligns with GOLI’s acquisition in Tirex, positioning it to benefit from the scheme’s boost to EV infrastructure.

2) Scope of Industrial lubricants: Over the medium term, the demand for Industrial lubricants is expected to outpace the consumption of automotive lubricants. Therefore, there is a possibility of average realised price to drop, leading to decrease in EBITDA margin. However, GOLI has continued to focus on high-growth niches within the Industrial segment, by emphasising on premium products. This is done through its participation in industry events and sequentially acquiring new marquee customers. As a result, we continue to expect the company to exceptionally increase both, its margin as well as volumes.

3) Plant expansion: GOLI aims to increase its capacity from 140,000 to 240,000 kilo litres by FY27. The additional capacity in Chennai is expected to come online earlier than Silvassa’s. We bake in execution risk in our numbers such that volumes reach 77% of announced combined capacity of the two plants by FY27.

4) OEM partnerships: The firm continues to cater to 40+ OEMs and plans to expand these further in the next few years. We continue to believe that the management will be able to increase these organically or inorganically, resulting in further rise in volumes, underpinned by the expansion in capacity.

5) Fluids for Data Centres: The company has developed two products: a highend (POA-based) synthetic fluid and a mineral-based fluid. These are undergoing proof-of-concept trials, with support from the company’s global technical team and its R&D centre in Chennai.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131