Accumulate Nuvoco Vistas Corporation Ltd for the Target Rs. 459 By Prabhudas Liladhar Capital Ltd

Premiumization to negate rising costs in H2

Quick Pointers:

* Cement prices were flat QoQ in Q2, with no Oct drop (ex-GST) in key markets, and no hikes expected in the near term.

* Premium product volumes are expected to grow by 25% in Q3 vs Q2 and a further 10% in Q4 vs Q3.

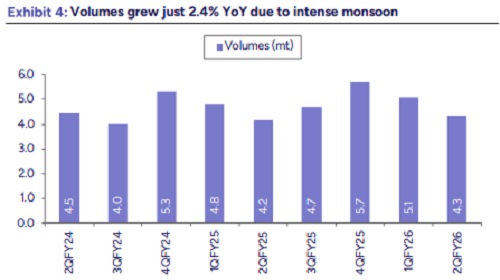

Nuvoco Vistas (NUVOCO) reported inline operating performance in Q2FY26, led by 1% increase in blended NSR. Volume grew just 2.4% YoY due to intense monsoon across the key markets. Pure cement average realization declined just 0.2% QoQ, on higher premium product share (44% from 41% in Q1); despite ~4% average price decline seen in the Eastern region as per our channel checks. Operating costs declined due to lower RM costs which declined led by longterm contract for slag and optimized fuel mix also aided in that. This led to EBITDA/t increasing by 64% YoY to Rs853 (PLe Rs846). The management will continue its efforts to reduce operating costs by Rs50/t in FY26 led by higher WHRS, higher AFR and lower lead distance aided by new railway sidings.

* Nuvoco is transitioning from a consolidation phase into a growth phase, having completed the Vadraj acquisition and guided a targeted ~4mtpa eastern expansion through equipment upgrades, process modifications, and debottlenecking, which will take total capacity to ~35mtpa by end FY27. These projects will also strengthen Nuvoco’s position in the East while providing access to newer markets in the Western and Central regions, driving regional market share gains and supporting product premiumization. Overall, Nuvoco offers a turnaround expansion story with improving financial metrics, scalable capacity, and operating leverage that could drive strong earnings recovery over the next two years. However, timely execution remains the key now. We cut our EBITDA estimates by 1% on flat pricing assumptions in H2 and expect it to deliver EBITDA CAGR of 20% over FY25-28E. The stock is trading at EV of 9.3x/7.4x FY27E/FY28E EBITDA. Maintain ‘Accumulate’ with revised TP of Rs459 (earlier Rs464) valuing at 9x EV of Sep’27E EBITDA.

* Revenue growth on strong pricing: NUVOCO’s cons revenue grew 8% YoY to Rs24.6bn (-14% QoQ; PLe Rs24bn) despite weak volumes. Volumes grew 2.4% YoY to 4.3mt (-16% QoQ; PLe 4.3mt) while blended NSR increased 1% QoQ to Rs5,715/t (PLe Rs5,548/t). Pure cement realization (ex-RMC) declined 0.2% QoQ to Rs5,158/t (5.7% YoY; PLe Rs5,064/t) on higher premium product share; despite ~4% average price decline seen in the Eastern region during Q2. Cement revenue grew 8.3% YoY to Rs22.2bn while RMC revenue grew 9% YoY to Rs2.6bn. Cement EBIT grew to Rs1.56bn while RMC business turned into an EBIT loss of Rs74mn.

* EBITDA/t growth driven by cost efficiencies and pricing gains: Cons. EBITDA grew 68% YoY to Rs3.67bn (-29% QoQ; PLe of Rs3.66bn) aided by lower RM costs. On blended basis, RM cost/t declined 11% YoY to Rs1,000 led by better priced slag supply on long term contract. P&F cost/t declined 2% YoY to Rs1,055/t led by optimized fuel mix and strategic sourcing. Freight cost increased 2% YoY to Rs1,505/t. Other expenses per ton increased 9% YoY to Rs887/t. Resultant, EBITDA/t grew 64% YoY to Rs853/t; inline with PLe of Rs846/t aided by lower RM costs and better pricing.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271