Hold Jubilant Ingrevia Ltd for the Target Rs. 695 by Prabhudas Lilladher Ltd

New projects to drive growth going ahead

Quick Pointers:

* Ground breaking completed for a new MPP at Gajraula, while a new R&D facility for the semiconductor segment is planned at Greater Noida

* Capex on track for the $300mn Agro contract, supplies to start early CY26

JUBLINGR reported a consolidated revenue of Rs11.2bn, broadly in line with our estimates. The Specialty Chemicals segment registered 12% YoY growth, driven by increased sales of CDMO, Pyridine and diketene derivatives. The Pharma side witnessed improved demand and stable pricing, while the Agrochemical portfolio volume improved but witnessed price volatility in Pyridine and Picoline leading to 140bps sequential decline in EBITDAM. Deliveries under the $300mn agrochemical CDMO contract are expected to commence by early CY26. The Nutrition segment saw a 1% YoY revenue decline, along with a 160bps YoY and 240bps QoQ drop in margins, primarily due to lower prices across the nutrition portfolio. Meanwhile, the Chemical Intermediates segment experienced a 20% sequential recovery in revenue, led by strong volume growth, although pricing continued to remain under pressure.

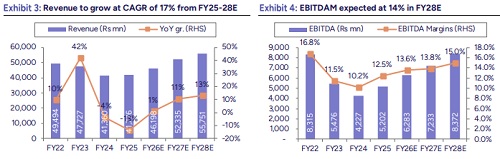

Looking ahead, we expect the Specialty segment to remain the key growth driver. However, pricing headwinds in the Nutrition and Chemical Intermediates segments continue to pose challenges. At an implied valuation of 28x Sep’27 EPS, we maintain “HOLD,” with a target price of Rs695, based on a sum-of-the-parts (SOTP) valuation approach

* Specialty Chemicals/Chemical Intermediate segment topline grew by 12%/6% YoY: Revenue stood at Rs11.2bn (up 7.2% YoY / 8% QoQ), broadly in line with the estimates (PLe: ~Rs10.9bn; Consensus: Rs10.9bn). The sequential increase was due to a 20% QoQ increase in the Chemicals intermediate segment.

* EBITDAM decreased by 160bps QoQ due to lower realisations: EBITDA stood at Rs1,355mn, up 8.8% YoY but down 4.7% QoQ, with EBITDA margin at 12.1% (vs 11.9% in Q2FY25 and 13.7% in Q1FY26; PLe: 12.8%), reflecting a 20bps YoY improvement driven by a higher Specialty mix. PAT rose to Rs695mn, marking 17.7% YoY increased but decreased 7.5% QoQ, with a PAT margin of 6%.

* EBIT margin of Specialty segment improves by 620bps YoY: The Specialty segment’s EBIT margin expanded by 620 bps YoY to 20.7% (vs 14.5% in Q2FY25). The Nutrition and Health Solutions segment saw a 200 bps YoY decline in margins. In contrast, the Chemical Intermediates segment’s EBIT margin improved 40 bps QoQ to 1.7% (vs 1.3% in Q1FY26) but declined 480 bps YoY.

* Concall takeaways: (1) New boiler is scheduled to be commissioned in Bharuch in Q3FY26. (2) $300mn Agro CDMO project is set for commissioning in Q4FY26. (3) A new R&D facility for semiconductors will be set up in Greater Noida. (5) Specialty segment volumes are improving across Fine Chemicals and CDMO segments. (6) In last 3 quarters 10+ new molecules were added in CDMO and Fine Chemicals. (7) Received approvals for 10+ molecules in last 1 year, with total revenue potential of Rs12bn, 1 molecule has been already shipped. (8) In Specialty Chemicals segment 10+ molecules in advanced stages with peak revenue of Rs10bn. (9) Pyridine plant was shut for maintenance during the quarter led to small decline in absolute EBITDA. (10) In Nutrition and Health segment Niacinamide demand showing uptick especially in high value products, and strong increase in volumes in Q2. (11) Choline Chloride volumes improved in Q2FY26 compared to Q1FY26. (12) EU anti-dumping duty on China Choline Chloride has led to higher order book which are expected to be realized in upcoming quarters. (13) In Chemical Intermediates Segment Paracetamol end use segment improving, pricing continue to remain under pressure. (14) A total of 18 new products are planned for launch in FY26. (15) Tariffs have been applied for only 2% of existing business

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271