Hindalco Reports Q2 FY26 Results Strong performance amid volatility, strengthened by Hindalco`s integrated business model

Key Highlights

* Consolidated PAT at Rs.4,741 crore, up 21%

* Aluminium Upstream quarterly EBITDA at Rs.4,524 crore, up 22%

* Industry-best Aluminium Upstream EBITDA margins, at 45%

* All-time high Aluminium Downstream quarterly EBITDA at Rs.261 crore, up 69%

* Copper EBITDA at Rs.634 crore, in line with guidance

* Novelis shipments at 941 KT, in line with the prior year period

* Novelis cost reduction initiatives target over $125 million run-rate savings by FY26 and $300 million by FY28

* Novelis Oswego plant to restart the hot mill in December 2025

* Hindalco announces Aditya Aluminium Phase 2 expansion of 193 KT

* Consolidated Net Debt to EBITDA at 1.23x as of September 30, 2025, vs 1.19x a year ago

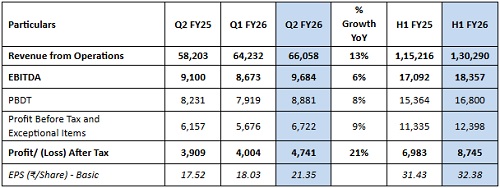

Hindalco Industries Limited, the Aditya Birla Group metals flagship, today reported results for the quarter ended September 30, 2025. Consolidated EBITDA for the second quarter stood at

Rs.9,684 crore, up 6% from the same quarter last year, and Net Profit increased to Rs.4,741 crore, up 21% over the prior year quarter.

The robust results were driven by a strong performance by the India business, and a resilient performance by Novelis. India Aluminium Upstream business delivered another standout performance with EBITDA at Rs.4,524 crore, up 22%, while Aluminium

Downstream achieved a record EBITDA of Rs.261 crore, up 69% compared to Q2 FY25. Despite headwinds, Novelis reported flat shipments over the prior year quarter.

Summary of Consolidated Financial Highlights for the Quarter and Half Year ended September 30, 2025

Commenting on the results, Mr. Satish Pai, Managing Director, Hindalco Industries, said,

“Hindalco continued its growth momentum amid global volatility, delivering strong performance in both volumes and profitability. This performance was driven by robust contribution from India business, disciplined cost management and operational efficiencies across segments.

The Aluminium Upstream business continued to outperform with industry-best EBITDA margins of 45%. The Downstream segment reported a solid quarter with 69% EBITDA growth, supported by all-time high volumes and a superior product mix. The Copper business remained resilient, performing in line with our guidance even with lower TC/RCs. Novelis recorded a sequential improvement in both EBITDA and Net Income, despite net tariff impact partially offset by better pricing and accelerated cost efficiency initiatives.

Our integrated business model, prudent capital allocation and focus on cost optimisation, continues to enable us to deliver sustained, resilient growth across market cycles.

Our sustainability agenda remains focused on climate action, circularity through waste recycling, water stewardship and biodiversity protection.”

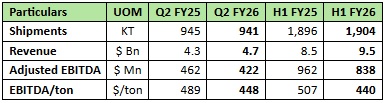

Segment-wise Performance for Q2 FY26 Novelis*

* Shipments flat at 941 KT

* Revenue at $4.7 billion, up 10%, driven by higher average aluminium prices

* Adjusted EBITDA at $422 million, down 9% due to the impact of tariffs

* Cost take-out run rate at more than $125 million by end of FY26

* Bay Minette and other strategic investments projects advancing well

* Oswego plant to restart hot mill in December 2025

*As per US GAAP

Aluminium (India)

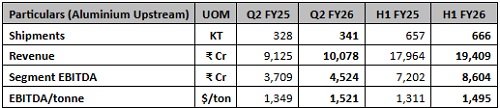

Aluminium Upstream:

* Quarterly Upstream revenue at 10,078 crore, up 10%

* Aluminium Upstream EBITDA at Rs.4,524 crore, up 22%, driven by higher volumes and realisations

* Aluminium Upstream EBITDA per tonne at $1,521, up 13%, with industry-best margins of 45%

* 2nd Phase Aditya Aluminium expansion of 193 KT announced, with a project cost of Rs.10,225 crore and expected commissioning in FY29

Aluminium Downstream:

* Sales of Aluminium Downstream at 113 KT, up 10%

* Downstream revenue at Rs.3,809 crore, up 20%

* Record Aluminium Downstream EBITDA at Rs.261 crore, up 69% on account of higher shipments and favourable product mix

* Record Downstream EBITDA per tonne at $265, up 49%

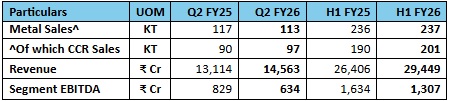

Copper

* Copper metal sales at 113 KT, down 3%

* Copper Continuous Cast Rod (CCR) sales at 97 KT, up 8%

* Revenue at Rs.14,563 crore, up 11%

* Maintained a healthy EBITDA of Rs.634 crore; in a declining TC/RCs market, offset with higher realisation from Sulphuric Acid

* Copper Tubes project progresses to commissioning phase

* Construction of copper recycling project progressing on schedule

Above views are of the author and not of the website kindly read disclaimer