Neutral Bosch Ltd For Target Rs.30,810 by Motilal Oswal Financial Services Ltd

Operationally in-line quarter

* Initiates another restructuring exercise to remain competitive

* Bosch’s (BOS) 3QFY25 operational performance was in line, while lower other income and higher taxes led to Adj. PAT miss at INR4.9b (up 5% YoY, est. INR5.4b).

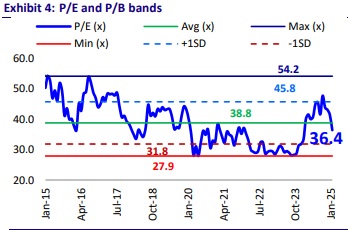

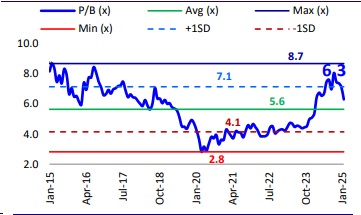

* The auto demand outlook continues to be subdued across key segments in the near term. We cut our FY25E/26E EPS by ~4%/8% to factor in a weak demand outlook and higher employee expenses. At ~38x FY26E/33x FY27E EPS, the stock appears fairly valued. We reiterate our Neutral stance on the stock with a TP of INR30,810 (based on ~35x Dec’26E EPS)

High employee expenses impact the EBITDA margin

* 3QFY25 revenue/EBITDA/PAT grew ~6%/1%/5% YoY to INR44.7b/5.8b/4.9b (est. INR45.4b/6.1b/5.4b). 9MFY25 revenue/EBITDA/PAT grew ~5%/8%/15% YoY.

* Its mobility segment grew 1.6% YoY, led by growth in the aftermarket (8.8%) and 2W (+23.9%) segments. The aftermarket growth was led by high demand for diesel systems, batteries, and lubricants, while the 2W segment growth was led by strong demand for exhaust gas sensors as well as the ramp-up of OBD2-based models by some OEMs. The after sales division is likely to grow at 8-10% in the long run.

* The consumer goods segment posted 8.8% YoY growth, led by the strong growth of grinders, drillers, cutters, spares, and accessories.

* The energy and building technology division also posted 8% YoY growth, which was supported by higher orders for the installation of public address systems and video surveillance systems.

* EBITDA margin came in at 13% (-70bp YoY/+30bp QoQ, est. 13.3%). Margins were impacted due to high employee costs, as the company continued to invest in new products. It expects employee costs to continue to rise gradually for the same reason.

* Segmental PBIT margins: Auto business - expanded 40bp YoY/70bp QoQ to 14.6%; consumer goods - margins stood at 4.7% (vs 11.7% in 3QFY24/ 9.3% in 2QFY25) due to seasonality factors; Others - 15.8% (-30bp YoY/+110bp QoQ).

* Further, lower other income and higher taxes led to a PAT miss.

* The company has allocated INR471m toward the restructuring of the business to sustain the competitiveness of the mobility division in India

Highlights from the management commentary

* BOS is in the process of further restructuring its operations to remain competitive in the mobility business in India. As part of this, it has provided INR 471m as an exceptional expense in Q3.

* The company has entered into an agreement with Keenfinity India Private Ltd (wholly-owned subsidiary of its parent company) to sell the Building Technology division’s products, comprising video systems, access and intrusion systems, and communication systems, for a cash consideration of around INR 5.95b. This segment generated revenue of INR4b and EBIT margin of about 6%. This sale is part of the parent company’s global strategy to exit this business at a global level.

Valuation and view

* The auto demand outlook will continue to be subdued across key segments in the near term. Further, while BOS continues to work toward the localization of new technologies, given the long gestation projects, its margin remains under pressure with no visibility of improvement, at least in the near term.

* We cut our FY25E/26E EPS by ~4%/8% to factor in the weak demand outlook and higher employee expenses. While BOS is outperforming the underlying auto industry growth with new order wins, visibility for margin recovering to 15-16% is low. At ~38x FY26E/33x FY27E EPS, the stock appears fairly valued. We reiterate our Neutral stance on the stock with a TP of INR30,810 (based on ~35x Dec’26E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)